Fillable Form Rent to Own Agreement

A Rent to Own Agreement is a document used in a legal real estate arrangement, granting a tenant the right to lease a rental property and buy it after his or her lease expires.

What is a Rent to Own Agreement?

A Rent to Own Agreement is a real estate contract between a landlord and tenant, allowing the latter the ability to buy the property he or she is renting after his or her lease with the landlord expires. In general, the parties agree to a term lease, perhaps one to several years. After the lease or rental term, an option to purchase is granted to the tenant, giving him or her the right to buy the rental property within a specified period of time. This right is given in exchange for a fee.

During the lease term, the tenant remains as a regular tenant obliged to pay monthly rent. The title of the property remains with the landlord until the tenant decides to use his or her option to purchase the property. However, in general, a tenant who does not exercise his or her right to buy does not have the benefit of refunding the option fee. A simple definition for the option fee is that it is non-refundable money that the tenant pays for the right or option to buy the property within a time period.

Also called lease-to-own agreement or lease-options, or lease with the option to purchase agreement, a rent-to-own agreement is a traditional buying arrangement between two parties. While this method has several financial benefits to both landlords and tenants, it must cover all important terms and conditions to avoid disputes and disagreements in the future between the involved parties. In addition, before entering into this type of agreement, it is advantageous and smart to seek legal counsel first. Consult with a licensed attorney expert in the field of real estate before agreeing to a rent-to-own arrangement.

Using a rent-to-own agreement could be a beneficial move for a tenant who aspires to own a house without the exhausting process of applying for a mortgage and the headache that paying for it causes. In addition, this arrangement allows a tenant to invest and build equity in a house while opening the option of eventually refusing to purchase. On the other hand, a landlord may benefit from this arrangement if he or she is having difficulty selling his or her rental property. The option period grants a landlord a long-term tenant and the luxury to not have to deal with the expense and cost of the upkeep of the rental property.

How to fill out a Rent to Own Agreement template?

From crucial information, such as the details of both the landlord and tenant and the property to payment terms and conditions, a rent-to-own agreement should clearly state all the necessary terms to avoid future conflicts and disputes.

Use the guide below to fill out PDFRun’s rent-to-own agreement template correctly.

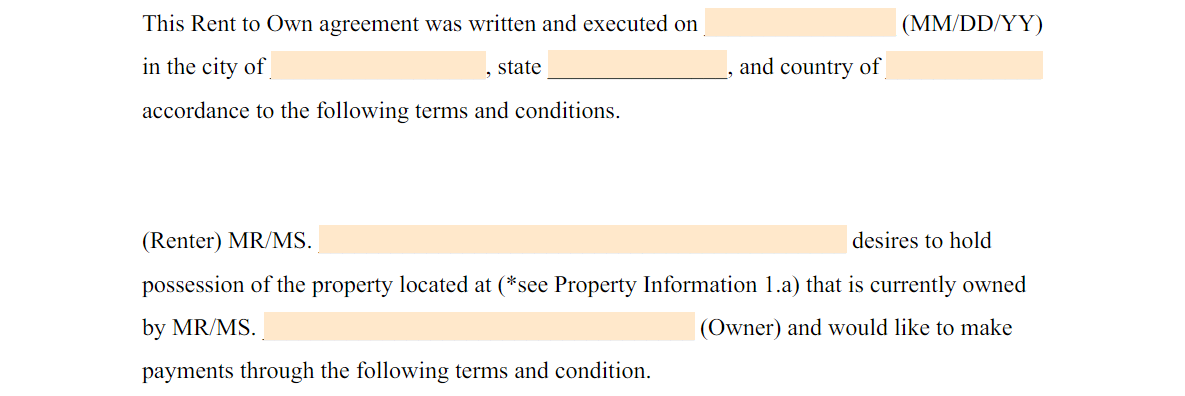

First, provide the date and location the agreement was completed and executed. Then, provide the full legal names of the renter and buyer.

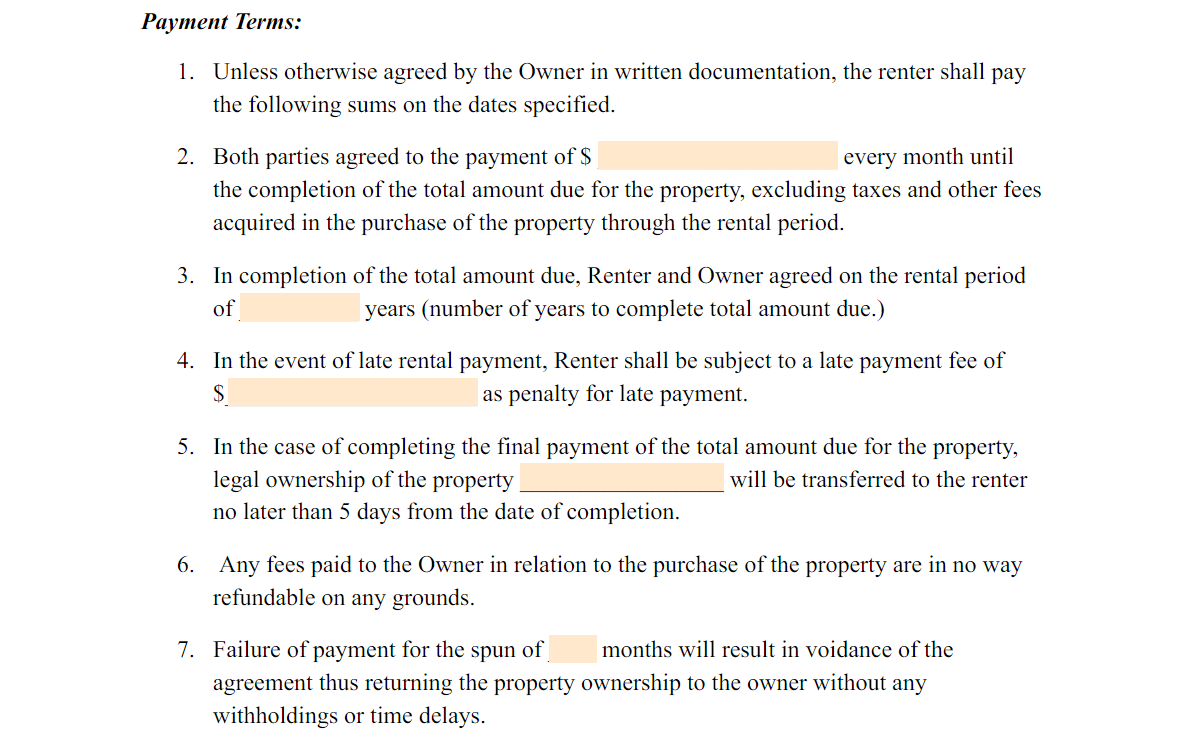

For the Payment Terms, it lists important conditions including the agreed payment every month until the completion of the total amount due for the property, the rental period, late payment fees, and terms in case of failure to pay by the tenant.

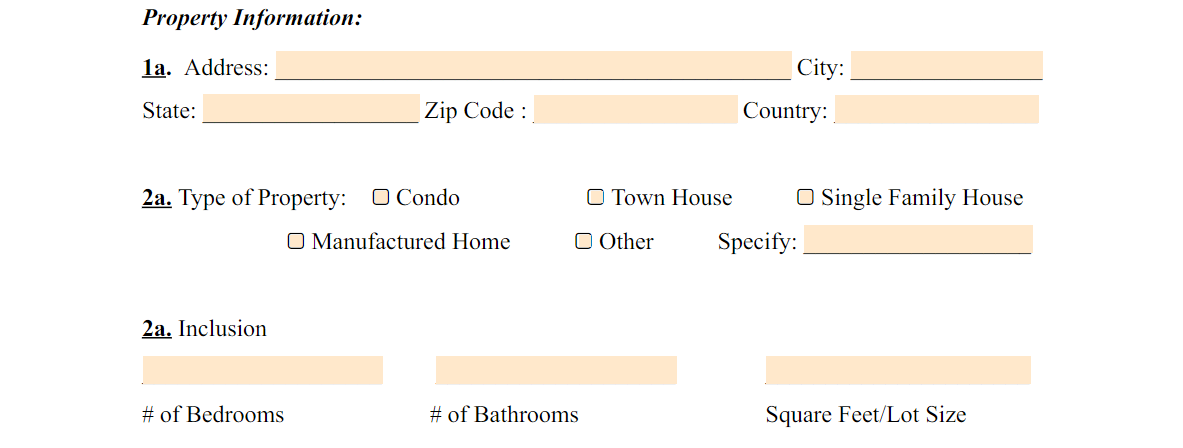

For Property Information, provide the complete address of the rental property, its type, and inclusion, such as the number of bedrooms, bathrooms, and its measurement or size in square feet.

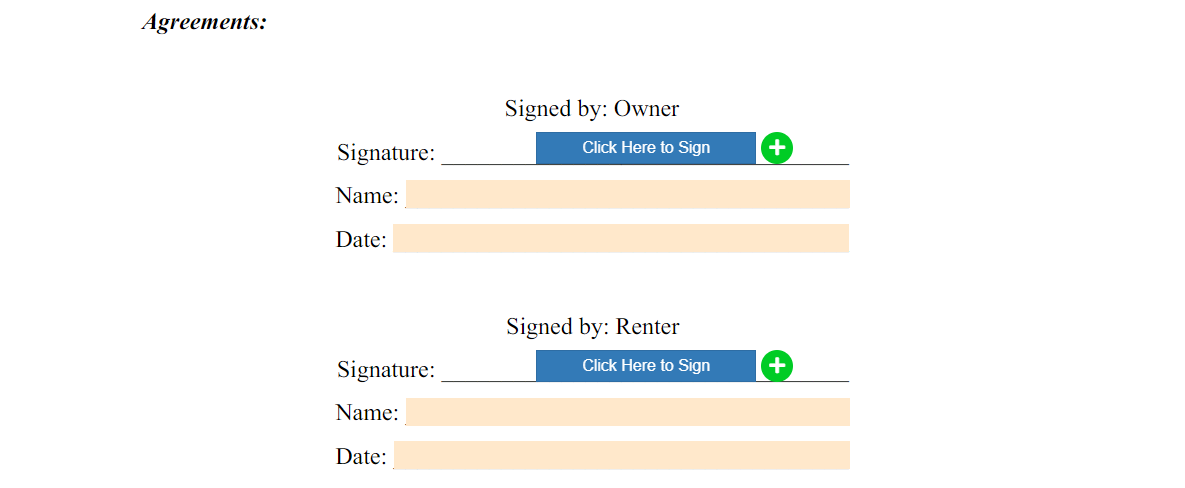

Lastly, both the landlord and tenant should provide their full legal names, signatures, and the date they signed to validate the rent-to-own agreement.

Frequently Asked Questions About a Rent to Own Agreement

What is the purpose of a Rent to Own Agreement?

A Rent to Own Agreement is designed to allow someone having difficulty qualifying for a traditional purchase and the opportunity to own real estate property. A Rent To Own Agreement can be beneficial to both parties because it allows for an easier transition into ownership of the property while allowing the buyer time to prepare themselves financially.

A Rent To Own Agreement can be beneficial to the seller of a property who would like more than just rent payments and is also more likely to get his or her renter to invest in maintaining and improving the house, yard, and exterior of the home.

Who files a Rent to Own Agreement?

A Rent to Own Agreement is a document that is filed by a tenant and an owner of a property.

A Rent to Own Agreement is used to facilitate a transaction in which someone wants to buy a home but does not have the credit ratings, assets, or down-payment required by a traditional lender. Renting "to own" is an alternative way of buying real estate property.

Renters with good references and income and those who have been renting for a long time might be eligible to rent a home or apartment "to own" from the current owner.

What is rent to own?

Rent to own is a form of alternative purchase in which the buyer rents a house for a predetermined amount over an agreed-upon period of time. Renting allows them to make improvements and eventually buy the home after they have satisfied the costs associated with purchasing it.

Rent-to-own agreements sometimes also include other terms, such as rent to qualify, lease option, or lease purchase. Rent to own is a variation of a lease option.

In rent-to-own transactions, the prospective buyer rents the home with an option to buy it within a certain time frame. Renters give a security deposit and usually pay a higher rent than they would for a nonrental dwelling of similar size and condition. Rent to own is often used by people who have poor credit or cannot qualify for a mortgage.

Renters may be able to make the payments earlier than originally anticipated because rent is not the only expense of ownership. Renters also pay closing costs, maintenance fees, homeowners insurance premiums, and property taxes on homes they purchase through rent-to-own agreements.

What type of property can be sold via Rent to Own Agreement?

A Rent to Own Agreement is used for various properties that are sold with rent-to-own terms. Rent-to-own properties can be a:

- house;

- single-family house;

- manufactured house;

- condominium;

- townhouse;

- apartment building;

- vacant land;

- commercial building; or

- mobile home.

Does a Rent to Own Agreement need to be notarized?

Although not necessary, a Rent to Own Agreement can be notarized to ensure its authenticity and credibility.

If you want to notarize your Rent to Own Agreement, you and the property owner must sign in front of a notary public officer to witness your agreement. Your Rent to Own Agreement will be signed at the time of notarization and will become valid after you receive a notarial stamp or seal.

By signing in front of a notary public, both parties are testifying that your signatures are not forged and that the Rent to Own Agreement is an agreement between two consenting adults in good faith.

Do I need a lawyer to make a Rent to Own Agreement?

Although it is not necessary to hire a lawyer when making a Rent to Own Agreement, it may be beneficial to do so. A Rent to Own Agreement can be complex and difficult to understand.

The lawyer will help ensure that the Rent to Own Agreement is fair for both parties as well as keep track of deadlines, taxes, and other important factors.

It is beneficial to hire a lawyer because Rent to Own Agreements are legally binding contracts that can be taken to court if either party breaks their end of the agreement.

If you want to rent-to-own a home or property, it is in your best interest to consult with an attorney before signing any Rent to Own Agreement so that you fully understand it and your rights and responsibilities.

What should be included in a Rent to Own Agreement?

A Rent to Own Agreement usually includes the following terms:

- terms of sale, including price, due date of first payment, and number of payments;

- amount of rent;

- length of Rent to Own Agreement;

- date by which Rent to Own Agreement must be signed;

- a statement indicating that buyer is not obligated to complete Rent to Own Agreement; and

- a statement indicating that the Rent to Own Agreement cannot be altered or changed without notarized written consent from both parties.

Do Rent to Own Agreements include security deposits?

Yes, Rent to Own Agreements include security deposits. The amount of the security deposits must be agreed upon drafting the Rent to Own Agreement.

Security deposits are the amount of money the buyer pays above and beyond rent. The property owner or seller uses them to cover any unpaid bills or repairs until Rent to Own Agreement payments is made in full.

Security deposits are non-refundable, so if the buyer terminates the Rent to Own Agreement within the first 15 days of signing it, they will not receive their security deposit back. However, buyers that terminate Rent to Own Agreements after day 15 will forfeit a portion or all of their security deposit.

Does Rent to Own Agreements need attorney review?

Most Rent to Own Agreements require an attorney's involvement for review or assistance in completing a Rent to Own Agreement. By consulting with an attorney during Rent to Own Agreement drafting, there can be less risk of Rent to Own Agreement violation or failure to adhere to state laws.

An attorney can provide guidance on terms and what should or should not be included in the Rent to Own Agreement.

Is it a good idea to do rent-to-own?

It is advisable to consider Rent to Own Agreements in certain situations. Rent to Own Agreements can be helpful for people who want to own a home but cannot afford the down payment or closing costs, do not qualify for traditional financing, or are looking in an area with high rent prices.

However, Rent to Own Agreements should only be considered after careful consideration. You should think through questions such as:

- Is the Rent to Own Agreement being drafted for a house that you really want? — Renting can be just as helpful if you have an idea of where you will settle down in the future or if your goal is to one day purchase a home. Rent prices are likely to increase over time, and Rent to Own Agreements can lock you into a contract of higher rent.

- Is the Rent to Own Agreement the only way for you to obtain the property? Rent-to-own arrangements can be expensive, so make sure that it is the best option for you. A Rent to Own Agreement is not recommended if the amount of your monthly payment is greater than the down payment you are able to afford.

- Will Rent to Own Agreements provide enough income? You should have a steady source of income that will be able to cover Rent to Own Agreement payments, rent for living quarters, and expenses. You should not enter Rent to Own Agreements if your income is unstable because if you fail to finish your payment plan, you could be evicted from the property. Rent to Own Agreements can lock you into a contract that includes rent and down payment for homeownership.

Am I allowed to terminate a Rent to Own Agreement?

Yes, you can terminate your Rent to Own Agreement with the property owner.

If you feel like you cannot continue paying for the property, you may terminate your rent-to-own agreement with the owner in writing. It is best to ask for legal assistance in this matter.

When you terminate your rent-to-own agreement, you may lose your initial and security deposit, and you may be unable to receive any refund of rent or other payments. Rent-to-own agreements often require buyers to pay a penalty when they terminate the Rent to Own Agreement, so this may be an option only if you have saved up money for a deposit on another place to live or can very easily obtain financing.

You may also want to rethink having a Rent to Own Agreement termination clause in your Rent to Own Agreement. This clause will outline what will happen if you and the homeowner decide that Rent to Own Agreements is not working out and you want to discontinue Rent to Own Agreement payments.

What are the things to remember when entering into a rent-to-own agreement?

If you plan to enter into a rent-to-own agreement, here are some things you need to remember.

- You must have a steady income. Rent-to-own agreements require a steady income that can support the payments or expenses on renting. If you fulfill all payments, the title of ownership of the property will be transferred to you. If you do not have enough income to fulfill all payments, your initial deposits will be forfeited, and the property will not be yours entirely.

- Rent-to-own agreements are a long-term commitment. You will be paying for the property for a long time. Thus, the Rent to Own Agreement may lock you into a contract for many years. It will require patience, hard work, and consistency on your part. It may also affect your long-term plans. For example, you got a job in another state, and the Rent to Own Agreement will not allow you to sell your end of Rent to Own Agreement back to the owner. However, the beauty of entering into a rent-to-own agreement is you have a test drive before buying the property. If you think you do not like the property due to certain reasons, you may terminate your agreement.

- Rent prices can increase. Rent prices are likely to increase over time, which means Rent to Own Agreements may suggest that payments will be higher in the future. Rent prices can fluctuate. However, Rent to Own Agreements often locks buyers into rent prices that are fixed for the agreement period.

Is a rent-to-own arrangement a bad idea?

A rent-to-own arrangement is not necessarily a bad idea. While others can buy a house or property outright, others cannot because they lack resources. Renting to own a property is beneficial for those who cannot afford to buy a house or property because it lets them live under a roof while paying for it.

However, a rent-to-own agreement requires qualifications for a person to enter into such a contract. It includes having a steady income and money for a down payment.

Rent to own may be disadvantageous if a buyer does not have a steady income or enough funds to pay the rent and down payment. This type of purchasing arrangement locks the buyer into a contract where he or she cannot discontinue payments without consequences.

What is the downside of rent-to-own?

The major downside of a rent-to-own is the buyer does not own the property unless all payments are fulfilled.

A rent-to-own agreement requires a buyer to pay the rent and down payment for a period of time within which either party can terminate Rent to Own Agreements with written notice.

If the buyer does not fulfill the payments or loses his or her job during this period, the owner may terminate their Rent to Own Agreement and keep the down payments or retain ownership of the property.

If you do not have enough income or money saved up, Rent to Own Agreements may not be a wise option for you.

How long are rent-to-own contracts?

Typically, a Rent to Own Agreement takes two to five years before a buyer or renter fully owns the property. This agreement is a long-term commitment. Those who pursue it should have enough patience and financial stability before entering into Rent to Own Agreement.

How much of a down payment do I need for a rent to own?

A Rent to Own Agreement requires the buyer to make a down payment before rent payments are made. The amount of Rent to Own Agreements is usually 20 %, but the parties may agree on any amount that offers protection for both buyers and sellers.

What will be the Rent to Own Agreement interest rate?

The Rent to Own Agreement interest rate varies depending on the sale price, property owner, and Rent to Own Agreement. Rent to Own Agreement interest rates can be as low as 2% or as high as 12%.

Rent to Own Agreement interest rates are usually lower than the mortgage rate, which is why Rent to Own Agreements are beneficial for some buyers.

Is paying rent a waste of money?

No, paying rent is not a waste of money.

Not all people have the resources to buy a home or commercial building outright. Thus, people consider renting as an alternative. The rent they pay pays for shelter and comfort. Renting allows them to live in a good neighborhood, establish relationships, and build roots before buying a property. It permits them more time to save up money by paying rent rather than mortgage payments and plan ahead without the pressure of immediate financial obligation.

However, paying rent can be a waste of money for them if they do it for a long time, more than they should. If plausible, they must save money to buy a property where they could live or operate business freely. Renting can also be a waste of money for buyers if they have enough income and funds saved up to buy the property outright.

When renting to own a house who is responsible for repairs?

The Rent to Own Agreement requires the buyer and seller to agree on who is responsible for repairs.

Sellers usually compensate for major renovations such as plumbing, electrical wiring, and roofing work. Renters may pay for minor repairs such as fixing a window or patching a hole in the wall depending on their Rent to Own Agreement.

What are the Rent to Own Agreement penalties?

A Rent to Own Agreement is used to set out the terms and conditions of a rent-to-own agreement, including the penalties in case of agreement breach.

Generally, the penalty in a Rent to Own Agreement breach is the voidance of the agreement, which could result in:

- retainment of the property;

- forfeiting initial payments; and

- paying a substantial amount to compensate for any damage.

These penalties may seem like bad news, but they are designed to protect both parties.

Is it cheaper to rent or own a house?

Owning a house is ideal for people who are ready financially to invest in a property. Renting an apartment has its perks too, especially for those with low income or poor credit history.

Buying a house is expensive; thus, people with low income tend to rent because they do not have enough money to buy a house. However, renting may seem cheaper, but it may cost you more expenses in the long run. When you buy a house, you do not have to pay monthly rent.

If you are a renter, you may consider the rent-to-own agreement to buy your own place. It is the best option for you as you will be given the opportunity to purchase the house by paying your monthly rent and other fees. If you fulfill all payments, you will own the house.

Should I buy or rent a house?

To decide whether rent or buy, you should weigh these factors:

- Do you have enough money to buy a house? Renting is ideal for people who are not ready financially to buy. So if you have enough money, it may be cheaper to buy a house, so you do not have to pay rent every month.

- Do you want to stay in this house for a long time? Renters can always move out and rent another apartment, while homeowners need to sell their property if they change their minds. Renting is ideal if you do not plan on staying in the same place for a long time.

- Do I like the area where the house is located? Renting is ideal for people who do not want to stay in the same area for too long. Renters can move out and rent another apartment if they change their minds, while homeowners may need to sell their property if they decide to relocate.

- Is my credit score good enough? Renting is ideal for renters with low incomes or poor credit scores. Renters can save money and rent to own a house in the future. Renting is not ideal if you have enough income and a good credit score since it would be cheaper to buy a house.

Why might people choose a rent a home rather than buy a home?

There are several reasons why people choose to rent instead of purchase.

For some, renting homes is an important option because they cannot qualify for a down payment or finance on their own. Renting provides the opportunity to establish good rental history while saving money for a future deposit.

Another reason that renting is better than buying is that buying a home requires significant up-front costs such as down payment and closing costs. Renting provides more flexibility to manage money, which can be beneficial for those with lower incomes or limited savings.

Additionally, renting is better in areas where renters do not plan on staying for too long. While buying a home could be the best decision if the location is ideal and they plan to live there for a long time.

Related Articles:

Keywords: rent-to-own rent-purchase rent-purchase-agreement rent-to-own-form rent-to-buy