Fillable Form Pay Stub

Calculate employee payroll and complete pay stubs with this form. A pay stub, payslip, or paycheck stub, is a document that an employer attaches to an employee’s paycheck on a payday.

Fill and sign Pay Stub online and download in PDF.

What is a Pay Stub?

A pay stub, payslip, or paycheck stub, is a document that an employer attaches to an employee’s paycheck on a payday. It contains information about an employee’s compensation, itemizing the wages earned for a pay period and year-to-date payroll.

Pay stubs can be in the form of an electronic or printed document. It must show taxes, deductions, contributions, and the net pay or amount the employee receives. Using this file, employees can make sure that they are paid appropriately. Employers, on the other hand, can use it to settle any salary discrepancies. In addition, they may use it to fill out an employee’s Form W-2 during a tax filing period.

When an employee is paid with a paper check, his or her pay stub is usually attached to the paycheck. For salaries directly deposited to a bank account, an employee’s pay stub is usually available online if a paper copy is not provided by the employer.

Federal labor laws do not require companies to issue pay stubs to their employees; however, many states have laws and regulations that require employers to provide a written pay statement for the protection of employees.

How to fill out a Pay Stub?

Get a copy of Pay Stub template in PDF format.

Once you are done with the computation of an employee’s earnings and deductions for a pay period, the next step is to complete his or her paystub.

First, get a fillable pay stub PDF template from PDFRun.

Then, follow this step-by-step guide:

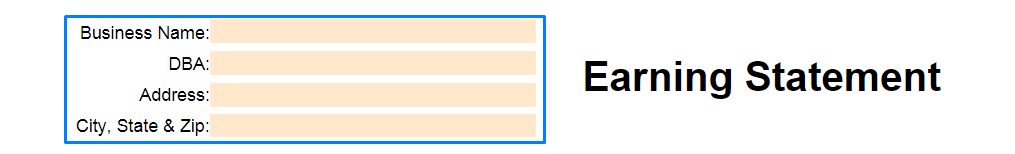

Business Nameasks forthe employer’s official business name.

DBA asks for the doing-as-business name.

Addressasks for the employer’s business address.

City, State, & ZIP asks for the city, state, and ZIP of the business.

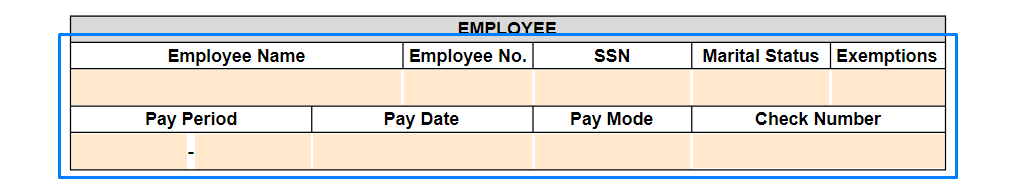

Employee Name asks for the full legal name of the employee.

Employee No. asks for the employee’s number in the company.

SSN asks for the employee’s Social Security Number.

Marital Status asks for the employee’s marital status.

Exemptions asks for any income-related exemptions that the employee may have, if applicable.

Pay Period indicates the pay period the pay stub was created.

Pay Date indicates the pay date that the pay stub was given.

Pay Mode indicates the mode that the payment was given.

Check Number indicates the check number given to the employee, if applicable.

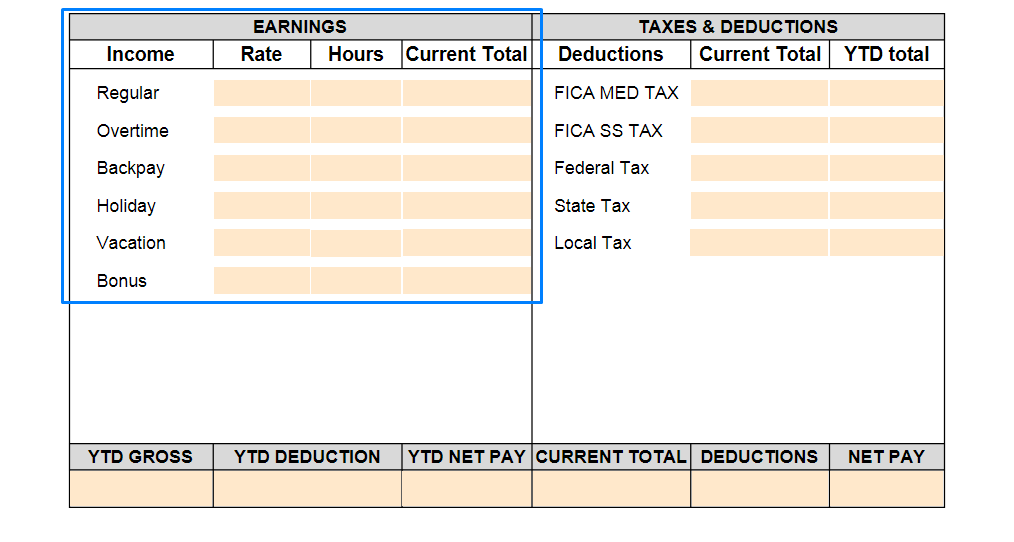

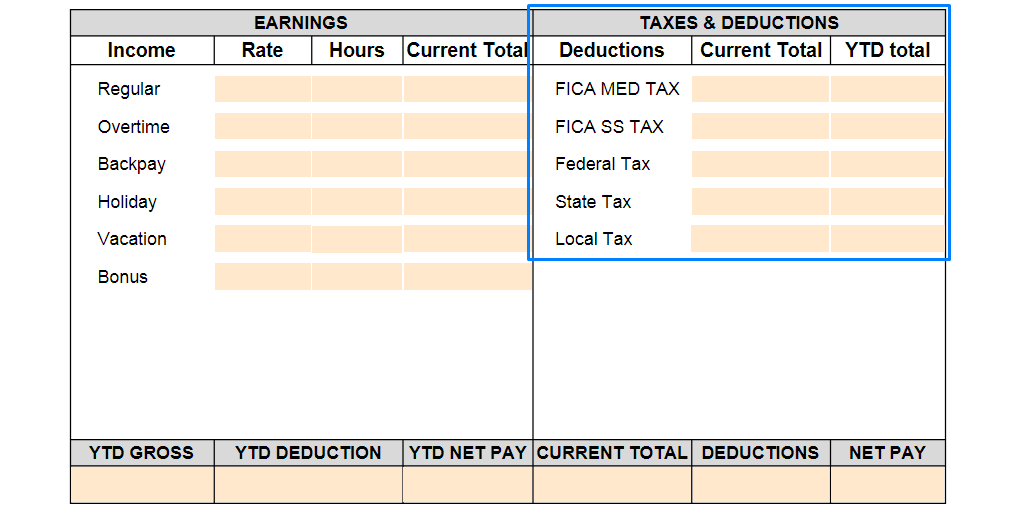

Earnings indicates the types of income the employee has earned, as well as the respective rates, hours worked, and current total.

Taxes and Deductions indicates the types of taxes and deductions the employee has, as well as the respective current total and year-to-date total.

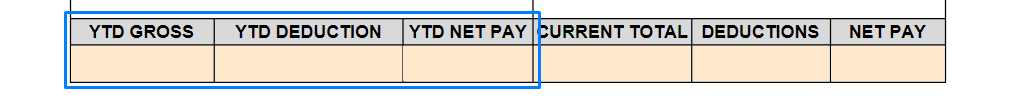

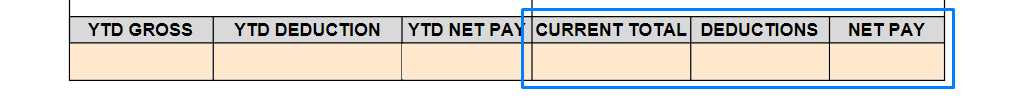

YTD Gross indicates the employee’s year-to-date gross income.

YTD Deduction indicates the employee’s year-to-date deduction.

YTD Net Pay indicates the employee’s year-to-date net pay.

Current Total indicates the employee’s current total earnings for the pay period.

Deductions indicates the employee’s total deductions for the pay period.

Net Pay indicates the employee’s net pay for the pay period.

Start filling out a Pay Stub sample and export in PDF.

Frequently Asked Questions About Pay Stub

What is on a paystub?

A pay stub shows in detail how much money an employee has earned and how much money the employer has paid out. The stub may include details on bonuses, deductions to pay for benefits, taxes, etc. Pay stubs are prepared by the employer and given to the employees as a record of their income and employment history.

The following items should normally be included on the pay stub:

- gross earnings;

- deductions for taxes, contributions to social funds or other payments, if any;

- net amount paid out.

How do I get pay stubs?

You can get your pay stubs from your employer in a number of different forms including printed paper copies, online versions, and mobile phone apps.

The method you use to get your pay stubs depends on the type of job you have as well as the policies companies have regarding their employees getting access to them.

Can I see my pay stub online?

You may view your pay stub online if your company uses web-based payroll services. Many businesses provide their employees access to an online portal, which allows payment stubs to be viewed and printed from a personal computer.

Is a pay stub the same as a paycheck?

A pay stub is different from a paycheck, in that it contains information about your specific income for a given time period. This information includes the amount of money you have earned, your tax deductions, any mandatory deductions, or other expenses.

A pay stub can give you more insight into how much money is left over after all of the taxes are paid out.

A paycheck is less detailed, and only tells you the total amount that has been deposited into your account.

What is a 30-day Pay Stub?

A 30-day pay stub is used when they have paid you for less than a full month's work. In most cases, this is the pay stub that your employer will issue to you when you start working for them and/or any time there is a break in employment during the year.

What is a pay period?

A pay period on your pay stub is the period of time for which you are being paid (usually by the hour), without regard to the pay rate or your pay period mileage.

It's usually a one-week "work cycle," but shorter periods can be used if they make payroll more efficient. Some governments and large companies use two-, four- or six-week pay periods for the convenience of their payroll department.

It's important to know what your pay period is because that information determines how much you will be paid for your time. Also, most company benefits are figured based on a one or two-week "work cycle."

The standard U.S. work period is one week (ending on Saturday). Some governmental employers use the work period of one bi-weekly pay period (ending on Wednesday). Other very large companies have multi-week pay periods.

What is your net pay?

Net pay is the amount of money that employees receive after withholding taxes. The net pay is the total take-home pay or the amount an employee takes home each paycheck after all deductions are removed. Employers will withhold part of their workers' paychecks to cover state and federal taxes, Social Security, Medicare, and any other deductions required by law.

The amount withheld from a paycheck is determined by the state, the employer, and the employee. State agencies set rules for withholding, while employers must withhold taxes based on information they receive from employees on their W-4 forms. Employees may adjust how much money is withheld from each check to ensure that they pay what's necessary for taxes without giving too much money to the government.

What is a year-to-date gross income?

A year-to-date gross income is the sum of all gross earnings, which are inclusive of tips and any other cash amounts received by the employee in the pay period — from January 1 to December 31. A gross income does not include any deductions from pay, such as taxes, pension contributions, or insurance schemes.

How much taxes come off your paycheck?

The amount of taxes that come off a paycheck depends on the tax bracket each person falls in. There are different tax brackets so which one you fall under depends on how much money you make a year. If there is some part of the pay that goes to fees then that amount would not be considered when determining which tax bracket someone falls under.

What if your employer doesn’t give you a pay stub?

Employers are responsible for generating and providing pay stubs to their employees. If your employer refuses to provide your pay stub, you need to understand your rights and options under the law. You may seek help from a lawyer to learn more about their legal options in employment disputes.

Can you go to jail for fake pay stubs?

Creating or using fake pay stubs is against the law and can lead to serious penalties, including jail time. While some use them to document income or request raises, both unemployed and employed individuals have been caught using them for personal gain. No matter the reason, it’s a criminal offense.

Is making your own pay stub illegal?

Making your own pay stub is not illegal but it is against the law to falsely represent yourself as an employee of a company and it is illegal to use someone else's information to unlawfully file for unemployment.

A company may also create its own pay stub template and distribute it to its employees.

Is it illegal for an employer not to provide a payslip?

Employers are not required by law to provide payslips to their employees. However, they are required to keep accurate records of hours worked and wages paid.

Should hours worked be on a payslip?

Your hours worked should be on your payslip because it's a legal requirement. Your payslip must show:

- The number of hours you've actually worked in the pay period

- The number of overtime hours in the pay period

- The total amount of pay for the pay period

Your payslip must also show your hourly rate of pay, how many sick days you took and any allowances you're paid.

Does sick leave need to be on a payslip?

Any sick leave should show on your payslip. If it doesn't, you may report it to your employer, who may be able to add the information. Sick leave is often recorded in a different way on payslips and should not affect your normal pay.

Should I get my payslip before I get paid?

Your employer must provide your payslip on the day or before you get your salary. This will vary depending on when you get paid.

What are the advantages of receiving a payslip?

Payslips show your basic salary, allowances, tax deductions, and total hours worked—helping you track your earnings. They also ensure your pay is calculated correctly, protecting you from being underpaid, overpaid, or unpaid.

How do I know if my payslip is real?

To know if your payslip is real, check the following:

- Employee and Employer Info – Every payslip should have your name, job title, and employer details. If there's no contact info or the person who signed it can't be verified, it may be fake.

- Department and Position – Watch out for made-up departments or roles. Ensure the signer’s name and position make sense.

- Job Title, Hours, and Salary – Your job title should match your actual role. Make sure the hours worked and gross salary align with your contract.

- Pay Frequency and Deductions – Pay frequency should follow a logical schedule. Check that income tax and social insurance contributions are consistent with your pay.

- Gross vs. Deductions – Gross salary and deductions should make sense together. If something doesn’t add up, investigate.

- Suspicious Deductions – Unused or unfamiliar deductions may indicate tax fraud or underreporting.

- Contract and Format – Payslips should be typed, not handwritten, and match your employer’s usual format. If it looks odd, verify its origin.

- Income Tax Details – The tax withheld should appear on the payslip and match your tax return, if available.

Can HR verify salary?

Your employer's Human Resource Department can verify salary data.

Why do recruiters ask for payslips?

Some recruiters ask for an applicant's payslip to assess how much it will cost to hire that applicant. Nevertheless, it is unnecessary. The only relevant factors for employers to consider, when hiring staff, are whether or not an applicant has the skills and experience required for the job and how much that person should be reasonably paid based on those skills and experience. Anything else is irrelevant to determining pay rates.

What can I use instead of pay stubs?

Instead of your pay stub, you can use your payment receipts, your letter from the school indicating how many credits you will be earning, and a letter from your employer instead of a pay stub. You can use other proof as well but the essential part is that it should cover a full calendar year, show your name and social security number, indicate how much money was earned in wages, and should have either a signature or a stamp from the employer.

Can you request a pay stub from an employer?

Yes, you can request a pay stub from your employer as proof of income. Some employers may ask that you provide some sort of documentation showing how long you've been working for them and what your salary is before they will agree to give you a pay stub, but most will comply if asked. If you don't bring up the subject first, some companies only send out paystubs upon request.

How do I get my pay stubs from an employer?

To get copies of your pay stubs from your employer, you may send a request from your employer's Finance Department, Human Resources Department, or the Employment & Benefits Department. You can also visit your employer's office in person.

If you are denied access to your pay stubs, you may ask for a copy of payroll records instead if they could release this information. If they refuse, you can file a complaint with the Department of Labor, or bring a lawsuit in court.

Is it safe to email pay stubs?

In general, it is safe to email pay stubs. Just make sure that the information of the recipient is correct to avoid sending your pay stubs to the wrong people. For an additional security measure, you can delete the email from your sent folder. In case you need another copy of it, simply print a copy. If you need another one, you can ask for a replacement pay stub from your employer or Human Resources department.

Can I sue my employer for not giving me pay stubs?

You may sue your employer for refusing to give you pay stubs, as it is your right as a worker to know the details of your salary. You may do so if suing your employer is the only and final way to obtain your pay stubs.

Should you throw out pay stubs?

You may keep your pay stubs for up to a year just to make sure that you have all of the information you need to complete your tax return. Whether it's because you're missing one last bit of info for this year or just want to make sure that next year's return will be as simple as possible, now is a good time to start organizing those receipts and pay stubs.

What happens if I lose a paystub?

If you lost a pay stub, you can request from your employer a statement that summarizes your pay and deductions for a given period. Such a statement is called a pay stub summary.

You can ask your employer to send you such a written document by mail, or the employer may ask you to pick up the statement in person.

If you prefer just a copy of your pay stub, you may inform your employer.

Can you buy a car with fake pay stubs?

Falsifying your income to get an auto loan—or any loan—is illegal in all states. Lenders rely on accurate income info to ensure you can afford monthly payments, repairs, and other obligations.

This applies to all types of loans: mortgages, student loans, car refinancing, and credit cards. If caught, you could face jail time, hefty fines, repayment with interest, and other penalties.

Lenders can cancel your account immediately if they discover the fraud. If found later, your situation may worsen—credit bureaus may flag your report, lower your score, and mark you as high-risk.

Create a Pay Stub document, e-sign, and download as PDF.

Keywords: pay stub pay-stub pay stub template pay stub download fillable pay stub template