Fillable Form Sales Invoice

A Sales Invoice is a document sent to a customer with a list of products or services from a seller. It also includes their prices, any sales tax, the total amount, and the date before which the customer must pay.

Fill and sign Sales Invoice online and download in PDF.

What is a Sales Invoice?

A Sales Invoice, also known as a purchase invoice, commercial invoice, or simply invoice, is a business document issued by a seller to a buyer to inform the latter of the amount he or she owes in exchange for goods or services that have been sold or provided. It establishes a commitment on the part of the buyer to pay for the purchased goods or received services. Mainly, it serves as written verification of the agreement between the individuals involved in a sales transaction, creating an account receivable.

As an important bookkeeping and accounting document, a sales invoice enables a business to keep a record of all transactions for future reference. While its primary purpose is for maintaining records for an accurate and well-monitored bookkeeping system, it is also a crucial document for verifying claims on tax returns, managing inventory to ensure that the number of goods or products on hand is sufficient to fulfill current and incoming orders, protecting a business from unsubstantiated lawsuits as it displays important transaction information, and creating business plans particularly those that require forecasting.

How to fill out a Sales Invoice?

Get a copy of Sales Invoice template in PDF format.

A sales invoice consists of the information of both the seller and the buyer and the list of the purchased goods or services, including the details of each order, such as the quantity and amount. Some invoices may include payment terms and order-specific information.

To understand the business document better, below are the descriptions of some fields found in sales invoices and how to fill them out.

- Company Name, also known as the vendor, is the business name of the seller. It is usually listed at the topmost part of the sales invoice. If you are a business owner, provide the full business name of your company.

- Address is the business address of the company or vendor.

- Contact Number is the business phone or mobile number that the company uses that customers may contact.

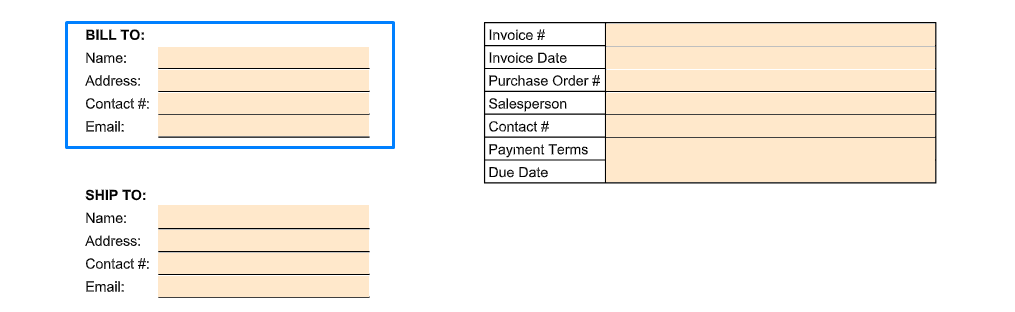

- Bill To contains the information of the buyer, such as his or her name, address, contact number, and email address. If it is a business-to-business transaction, provide the official business name of the client company, its business address, contact number, and email address.

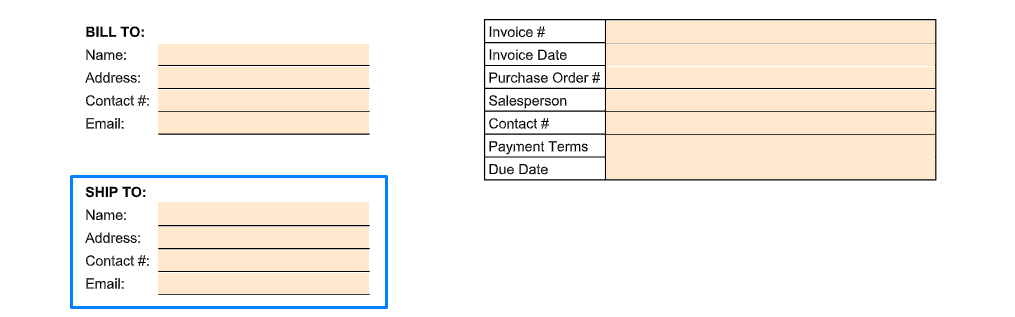

- Ship To is similar to the Bill To section. It contains the shipping information of the buyer, including his or her name, address, contact number, and email address. If it is a business-to-business transaction, provide the official business name of the client company, its business address, contact number, and email address.

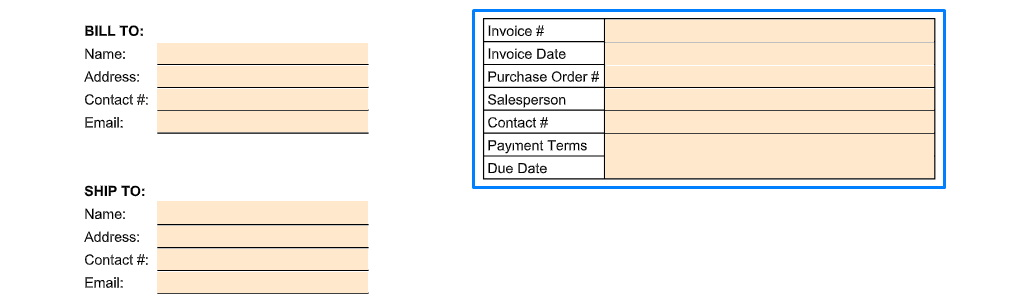

- Invoice Number lets the seller distinguish one transaction from another. This is a unique combination of numbers following a specific format.

- Invoice Date shows the date the sales invoice was sent.

- Purchase Number is a unique combination of numbers. Similar to the Invoice Number, it lets the seller identify one purchase from another.

- Salesperson is the person in charge of the sales transaction.

- Contact Number is the contact number of the salesperson.

- Payment Terms and Due Date detail the terms and conditions of the payment that must be met by the customer, such as the payment method and due date.

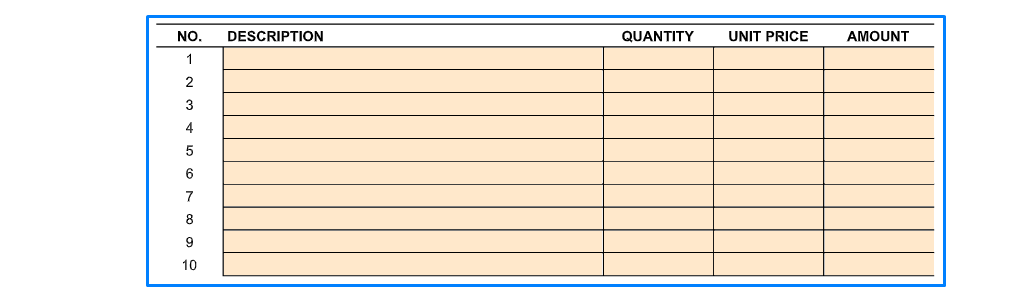

A sales invoice contains a table that shows the details of items purchased, either products or services. For each item, the Description, Quantity, Unit Price, and Amount should be supplied. Once all the purchased products or availed services are listed, proceed to the computation table.

The computation table showsSubtotal and Tax. If applicable, include in the computation the Shipping and Other Fees that apply. Lastly, compute for the Total.

Start filling out a Sales Invoice sample and export in PDF.

Frequently Asked Questions About Sales Invoice

What is the purpose of a sales invoice?

A sales invoice is a document containing a record of a sale and the details of the items sold. It is used for obtaining an invoice number, communicating with suppliers, communicating with customers, and compiling records of sales. Companies use a sales invoice to communicate to customers the types, quantities, and prices of products or services they have bought. The sales invoice is also used for accounting purposes to record credits received from a customer.

What is the difference between a sales invoice and an official receipt?

A sales invoice and an official receipt are two different accounting documents. A sales invoice is a document notifying the purchaser of the products or services they have bought from a seller, while an official receipt is a document verifying that certain money has been paid by a particular person to the government. Both documents contain some information in common: name and address of both parties, the date on which the transaction took place, and type and amount of goods sold.

What should a sales invoice include?

a sales invoice is a brief, written document that lists goods sold and the terms of sale between a vendor and a purchaser. It is created by the sales department to document the sale of products or services. Sales Invoice records detail the exchange of goods and cash between two companies, indicating the quantity of the items, the amount per item, the conditions of the items, the place of delivery, and the name of the people or companies involved in the transaction.

Who gets a sales invoice?

The seller gives the sales invoice to the buyer and requests payment, as it serves as proof that a transaction has occurred. A sales invoice details the products or services purchased, any discounts applied to the purchase, taxes collected, and the amount due.

Is a sales invoice an official receipt?

A sales invoice is not an official receipt. It is a commercial document and evidence of the contract of sale between a seller and a buyer. It should contain among other things: the date, full name and address of both parties — sellers and buyers, details about the goods sold, quantities, prices per unit or total price (incl. taxes). It may also include information about the transport, payment conditions and guarantees.

It is important to note that a sales invoice is not an official receipt nor does it confirm that the seller will actually complete the order. The only evidence of the contract of sale between a seller and buyer is an official receipt.

Although the words invoice and receipt are often used interchangeably, they actually refer to two different commercial documents.

An invoice is a document showing that goods have been supplied or work has been done. It lists what was provided and for how much. Usually, it is sent after the goods or services have been supplied or work has been carried out and enables the buyer to check whether the price is correct. An invoice determines the amount that must be paid by the due date, usually 30 days from the date of issue or dispatch.

An official receipt, on the other hand, confirms that a seller has received money for goods supplied or work carried out. It shows what was provided and for how much. It usually accompanies the goods or is given to the person who did the work. It determines the amount that must be paid by a certain date, normally within 30 days of issue.

What are the disadvantages of invoices?

Some disadvantages of using invoices are:

- Invoice manual entry increases data entry errors and the risk of accidentally skipping an invoice.

- The process for matching invoices to purchase orders is time-consuming, tedious, and often results in invoice duplication.

- Invoices cannot be readily analyzed or compared because there are no data fields that standardize the information. This makes it more difficult to manage the invoice-to-purchase order process and keep track of spending.

- Invoices not matched to purchase orders result in delayed billing, non-revenue earning activity, and an increased risk of bad debt.

What are a sales invoice and a purchase invoice?

A sales invoice and a purchase invoice are two types of invoices that businesses issue to document their transactions. The business sends the invoice to the customer, who uses it as proof of purchase or payment when filing taxes. A sales invoice is issued by a business to its customer at the time of sale; a purchase invoice is issued by the supplier for goods sold to its customer.

A sales invoice serves as a bill for goods or services that the customer has purchased. It outlines the items and amounts in detail and is usually paid in full at the time of purchase by cash, check, or credit card.

A purchase invoice serves as a receipt when the supplier supplies items to its customer. The invoice will outline what was bought and how much was paid for the goods, and the customer will often pay the supplier via check.

A business uses a sales invoice to document its sale of goods or services to customers. Sales invoices are sometimes accompanied by credit slips, which provide information about discounts given on certain items sold in conjunction with other items. The business might use a purchase invoice when it lends inventory to another business or claims to have lost an invoice for a sale. The supplier may use the form when it is shipping goods to its customer.

Although both types of invoices are essentially statements of accounts payable, there are some significant differences between them. A sales invoice contains more information than a purchase invoice, and the information is set out in a different way. For example, a sales invoice usually contains an itemization of all items sold and their costs, along with other information like discounts given and the total amount due. A purchase invoice provides less information about individual items but may contain additional details such as freight charges and insurance costs.

Purchase invoices are sometimes used to confirm the amount of inventory provided, so it is common for them to include a count of the items.

Is a billing statement the same as a sales invoice?

A billing statement and a sales invoice are two different documents. A billing statement is a document that outlines all of the purchases you've made on your account with an organization. A sales invoice, on the other hand, is an itemized list of goods or services purchased by a customer from a vendor.

Billing statements are typically sent to customers monthly and contain information about each purchase they've made over the past month. The purpose of a billing statement is to provide a summary for customers in case they need to reference their transactions in the future.

Sales invoices, on the other hand, are sent by vendors to customers that purchase goods or services from them. They can be itemized lists detailing what goods or services have been purchased and how much the customer owes.

In general, a billing statement is an overview of all purchases made on your account with an organization, while a sales invoice outlines what you purchase from the organization and how much you owe for it.

Can an invoice be a receipt?

An invoice is not a receipt. This is a basic fact that many people have forgotten or ignored completely. It's not a matter of opinion, it's black letter law, and the difference between an invoice and a receipt is critical to you as a consumer. An invoice includes details about your purchase, including the price of the item being purchased, shipping charges, taxes charged on the item or service, and any additional fees tacked on. A receipt simply confirms the purchase of an item, typically at the price you were quoted in person by a representative of the establishment.

How do I make a sales invoice?

If you want to make your own sales invoice in the United States, start with a header that includes your business name and address. Next, add a line for each product you sold to your customer.

Part 1 of 2: The header

Include your company information on the invoice header.

- Company name and address — At the top of your sales invoice, include your business name and address. This helps prove that you're a legitimate business and not an impostor.

- Contact information — Include your company's contact information such as phone number, fax number, or email address on your sales invoice so people can get in touch with you if they have questions about the invoice.

Part 2 of 2: The items sold

Create a separate line for each product or service you sold to your customer. This is where you'll list your company name, your customer's contact information (such as their address and phone number), and the date of sale. You'll also want to give a description of each item you sold.

Let's say you're selling multiple items that are part of the same order. You can include an item number or Stock Keeping Unit (SKU) on your invoice to help keep track of which product goes with which customer.

Add in your state's sales tax rate on your invoice. Generally, states collect sales tax from customers and then provide it to the state revenue department.

If you're a business owner in most U.S. states, you also need to pay business taxes. These include:

- Your state's corporate income tax (a percentage of your company's total net income).

- Your city or county business license tax (a percentage of your company's net income).

You'll also want to charge a convenience fee, such as an extra dollar amount for using a credit card instead of cash. You can do this by adding a line that reads "Credit Card Service Charge" or "Convenience Fee." This lets your customer know that you're not actually charging them more for using a credit card. You're simply passing along the cost of accepting that form of payment to the customer.

How is a sales invoice recorded?

Companies record sales invoices by date of purchase, not the date of payment.

That means the numbers on the invoices reflect when you bought something, not when you paid for it. As a result, if your accounts payable clerk processes all invoices in the date order they will appear to be perfectly correct even though some customers paid for their order long after it went out the door.

On the other hand, an accounts receivable clerk who processes invoices in order of when they are received will see customers' payment dates rather than purchase dates, which means you can use accounts receivables to find out exactly when customers paid for their orders.

What are the types of invoices?

There are two types of invoices: sales invoices and purchase invoices. The main difference being that a sales invoice is for the seller to report what they have sold, while purchase invoices are for the buyer to report what they have purchased.

One of their many functions includes tracking purchases made by an organization, reporting the financial impact of operations, and determining asset worth. Invoices differ from receipts in that an invoice will contain a list of items, quantities, prices, and totals.

Accountants are both the creators and users of invoices. While sales invoicing is primarily used to report revenue earned from customers during a given time period, purchase invoicing is used to document expenses that occurred in accordance with financial statement transactions.

Invoices are essential in the world of accounting and finance, especially when determining whether a business has made or lost money.

What makes an invoice legal?

An invoice becomes legal when the person who issued it, obtained an endorsement of the consignee, or whoever is supposed to pay for the service.

Why do companies use invoices?

Companies use invoices to communicate with suppliers and customers. This communication facilitates business operations where companies pay for purchased goods and services by supplying the supplier with an invoice. Typically, invoices are used to provide information about transactions that have taken place between two parties. Companies use invoices to communicate with suppliers and customers to facilitate business operations where companies pay for purchased goods and services by supplying the supplier with an invoice. For example, a business owner pays for goods or services using an invoice sent to him by his supplier.

What is the difference between AR and a sales invoice?

An account receivable is different from a sales invoice in such a way that the former is issued by a company or an organization to demand payment for goods or services sold on credit, whereas the latter documents the sale of goods and services with immediate effect. Accordingly, accounts receivable are invoices not paid immediately since they are collected later. These may be due after one month, 90 days, or even after a year.

What is the difference between a sales invoice and a tax invoice?

The difference between a sales invoice and a tax invoice is that a sales invoice is not always required to be issued by the seller or vendor and is most often used for the sales of goods. A tax invoice is always required by law to be issued by the seller (vendor) and is used for the sales of goods or services.

Is an invoice a bill?

An invoice serves as a bill for goods or services provided. It is an important business document that spells out the terms and conditions involved in a transaction. It is not always an absolute requirement for completing a sale of goods or services, but it can serve as confirmation of such transactions and ensure efficient billing and collection procedures.

Does every sale need an invoice?

An invoice is valuable in every sale or purchase of goods or services. It is a document between the buyer and seller, which states the details of payment. The invoice consists of information on payment terms, shipping terms, price, discount, and tax amount.

The invoices are typically sent after an order is placed with the business or received by them for their services. An invoice is generated by the seller and sent to the buyer for payment.

Can you refuse to pay old invoices?

You cannot refuse to pay old invoices. It is your responsibility to pay for your purchases. If you refuse to pay, the only thing you accomplish is destroying your relationship with the business. At some point, a business will cut ties with a person who's abusing their goodwill. Moreover, a business can sue you for not paying your obligations.

How long do you legally have to pay an invoice?

You are required to pay within 30 days after receiving an invoice unless there is a specified date on when you should make a payment.

Can individuals issue invoices?

Individuals may issue invoices to corporations, small businesses, or even to a family if the individual works as an independent contractor or freelancer. The invoices are individualized to the particular person or business, unlike the usual invoices issued by a company. An invoice is issued after work has been completed but before payment is made.

Where are invoices used?

Invoices are used in companies when there is a need to store information about the company's operations in an organized way. Invoices make it possible for organizations and individuals to keep records of their financial transactions in a simple and systematic way. These instruments serve as proof that money has been exchanged and that one party has received goods or services provided by another. Mostly, the accounting or finance department of a business is the one responsible for invoices.

How do I issue an official receipt?

To issue an official receipt for any money received, the company must prepare an invoice. Your invoice should include the term "invoice," your business name and address, a description of the products or services you provided, a unique serial number that distinguishes it from any other invoices you have issued, and a breakdown of prices charged for each item. You should store copies of all your invoices in a safe place.

How do I get an official receipt?

The company where you purchased products or availed of services must give you an official receipt after your payment. If you were not given one, you have to request one. An official receipt will serve as your protection in case you are being charged for an extra or unnecessary product or service.

Is a sales invoice debit or credit?

When the sales invoice is paid, it is considered a debit. The funds are then paid out of the business's account. Likewise, an accounts receivables invoice is a credit to your firm, and it increases cash within the accounting system.

What type of account is a sales invoice?

A sales invoice indicates the revenue that your company has earned. It is important to maintain financial records of your invoices in order to track your company's revenue and generate tax documents for the authorities.

What is a valid sales invoice?

For a sales invoice to be valid, there are a few things that need to be included in it. The main components are the merchant information, customer information, order number, date of sale, payment terms, and product descriptions.

Is it illegal to send fake invoices?

Sending fake invoices is punishable by the law. You should not manipulate the details in an invoice in order to get the client to pay. This is illegal.

What happens if an invoice is incorrect?

If you receive an incorrect invoice you must contact the company that provided you with products or services and have the invoice corrected. Businesses are not obligated by law to pay incorrect invoices but they are obligated to take reasonable steps to correct them if requested to do so.

Is faking receipts illegal?

Faking official receipts is illegal. It is a crime. Doing so can result in stiff fines and even imprisonment. Using an official receipt to claim false expenditure is fraud.

Create a Sales Invoice document, e-sign, and download as PDF.

Keywords: sales invoice invoice invoice sales a sales invoice sales invoice template sales invoice pdf sales invoice format