Fillable Form Direct Deposit Authorization

A Direct Deposit Authorization Form is a document that states that a third party is authorized, usually as an employer for payroll, to send money to a bank account by simply using the ABA routing and account numbers.

Fill and sign Direct Deposit Authorization online and download in PDF.

What is a Direct Deposit Authorization Form?

A Direct Deposit Authorization Form acts as a document that authorizes a third party to send money to a bank account using ABA routing and account number. A third party may be an employer that would enroll an individual in their payroll.

Direct deposit is a way to deposit money to an individual’s bank account. It is transferring money from one bank account to another. The depositor may either use cash, check or electronic payment. Today, most businesses favor depositing using electronic payment due to their convenience and security. When adding an employee to a payroll schedule, an employer will be responsible for deductions. Deductions may be government deductions, including Federal Income Tax (FIT), Social Security, Medicare, State Tax deductions, and other local income taxes; and other essential deductions, such as Health Insurance, Retirement Plans or 401(k), and other employee-mandated deductions.

Once the direct deposit authorization form has been completed by the account holder, it must be signed and returned to the employer to start the process of direct deposit enrollment.

Setting up direct deposit can take up to a few days or weeks. Aside from completing a direct deposit authorization form, a professional may ask his or her employer what to expect next and if there are other additional documents that he or she needs to submit to complete the enrollment process. Once the enrolment is done, his or her salary will arrive in his or her bank account automatically.

If you are an employee, compared to the traditional way of physically visiting a bank to do payroll-related transactions, a direct deposit proves to be more beneficial. As soon as your pay has been processed and transferred by your employer, it goes immediately into your account without delays. In addition, you do not have to worry about misplacing or losing your paycheck, as your pay will be electronically deposited. The biggest advantage of a direct deposit transaction is its security, as such an arrangement eliminates the threat of theft.

How to fill out a Direct Deposit Authorization Form?

Get a copy of Direct Deposit Authorization template in PDF format.

Completing all the required information is necessary for a direct authorization form to be valid and to ensure a smooth process of approval with a bank. Moreover, double-check all the information before submitting the form to avoid errors.

PDFRun has a direct deposit authorization form that you can use to enroll in and authorize a direct deposit. Follow the guide below to complete the form correctly.

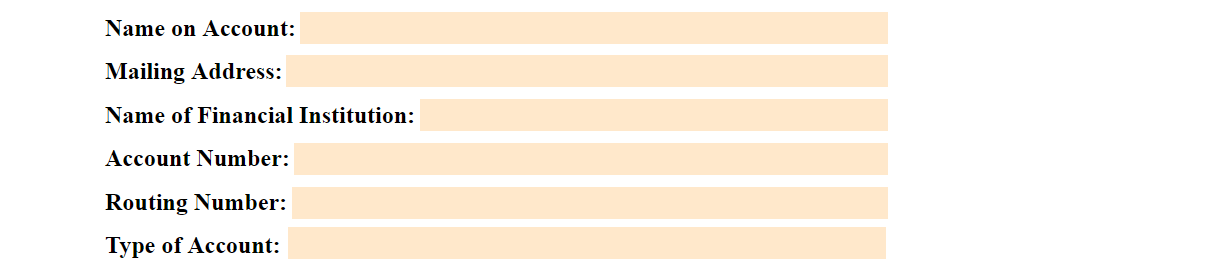

Provide the following personal information:

- Name on Account

- Mailing Address

- Name of Financial Institution

- Account Number

- Routing Number

- Type of Account

You may attach a voided check for each bank account to which funds should be deposited, if possible, to help confirm your personal and banking information.

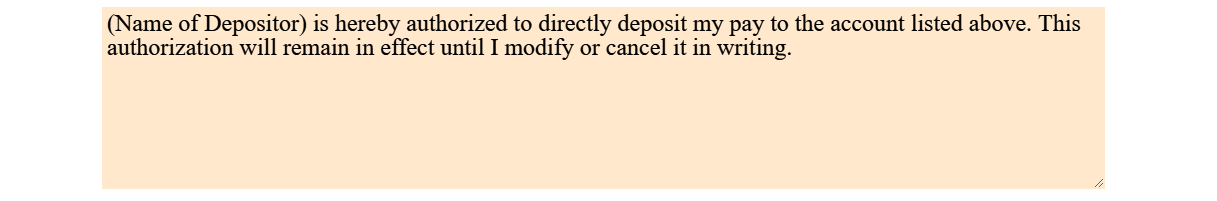

Include a brief statement declaring that you are allowing a direct deposit to your account.

Provide your signature and name and add the date the form was completed.

Start filling out a Direct Deposit Authorization sample and export in PDF.

Frequently Asked Questions About A Direct Deposit Authorization Form

Where to get a Direct Deposit Authorization Form?

In order to direct or authorize your employer or any person or company to make direct deposits into your bank account, you have to complete a Direct Deposit Authorization Form. You can get a fillable copy online.

Once you are finished filling out the Direct Deposit Authorization Form, it should be signed by your employer or anyone who will directly deposit your money.

What is a direct deposit?

A direct deposit is a direct payment of your salary or other money to your bank account. This process is also called direct credit and direct crediting. It can be done by a third party such as an employer, creditor, corporate trustee, or business partner.

Who should I issue a Direct Deposit Authorization Form?

If you want a direct deposit of your salary, bonus, retirement allowance or any other amount to be paid directly into your bank account, you need to issue a Direct Deposit Authorization Form to the person who is in direct control of your payment. This can be your employer, creditor, business partner, or a corporate trustee.

What are the advantages of direct deposit?

The following are the benefits of direct deposit.

- Convenience — Direct deposit is a more convenient option as it reduces the number of direct deposits that have to be made.

- Reliability — Direct deposit ensures that you receive your money on time and without any delays, unlike checks where delivery depends on whether they were lost or not.

- Reduction in Costs — Direct deposit saves the receiver from the hassles of cashing the direct deposit through a bank.

- Accuracy — Direct deposit ensures 99% accuracy as checks can easily end up in the wrong hands and could be cashed more than once.

- Safety — Direct deposit is free from theft as your salary, bonus, retirement allowance is directly credited to your bank account; and

- Efficiency — Direct deposit saves time and effort spent going to the bank or waiting and queuing for a check to clear.

- Speed — No need to wait for checks to clear anymore as a direct deposit is processed faster than other payment systems like cash, check, and money order that may take two to five business days.

These direct deposit benefits make it easier for you to access your money on a day-to-day basis.

Do I need a Direct Deposit Authorization Form for every direct deposit?

If you are receiving a direct deposit from only one account, you usually do not need a Direct Deposit Authorization Form for each deposit. Only if the direct deposit originates from two or more companies would you need to complete a Direct Deposit Authorization Form for each company.

Do I need a Direct Deposit Authorization Form?

You need a Direct Deposit Authorization Form if:

- your direct deposit is from more than one company;

- your direct deposit will be made from an account you do not own; or

- the direct deposit is made under your name but the people making the direct deposit are different from those listed as signatories for this bank account.

Use a Direct Deposit Authorization Form when using a direct deposit. It allows you to gather information with the owner's consent or permission.

What information should be included in a Direct Deposit Authorization Form?

Your Direct Deposit Authorization Form must include the following personal information:

- Name on Account

- Mailing Address

- Name of Financial Institution

- Account Number

- Routing Number

- Type of Account

It must also include the following:

- Name of the depositor

- Your statement authorizing the depositor

- Your signature

- Date of authorization

- The effective date of the Direct Deposit Authorization Letter

Do I need a direct deposit?

If you are receiving funds from your employer, creditor, business partner, or corporate trustee, the direct deposit will be more convenient and would save you time and effort. You also do not have to worry about not having cash when it is time for you to withdraw money.

How long does direct deposit authorization take?

The direct deposit authorization process takes about two to five business days depending on how fast your bank processes direct deposits.

Can I stop my direct deposit with a Direct Deposit Authorization Form?

No, you cannot stop your direct deposit with a Direct Deposit Authorization Form. Your direct deposit will be stopped by canceling your direct deposit authorization with the company where your direct deposit is coming from.

If you want to cancel direct deposits made to one account only, change the direct deposit details on that particular account at any time using online banking or direct contact with the bank.

Whenever you make changes or cancel direct deposit authorization, always inform each company in writing directly by phone or mail because, many times, they will reject direct deposit requests from other companies.

How long is a Direct Deposit Authorization Form effective?

Usually, a Direct Deposit Authorization Form contains the date when the authorization for a direct deposit remains in effect. You can direct deposit funds to your account throughout the term of the direct deposit authorization.

A Direct Deposit Authorization Form remains effective until you cancel the direct deposit in writing.

Can I cancel a Direct Deposit Authorization Form?

Yes, you can cancel a Direct Deposit Authorization Form.

You may withdraw your direct deposit authorization at any time, but it is always a good practice to ask the company before you withdraw your direct deposit authorization status.

If you cancel direct deposits, always send written notice to the depositor(s) and each company where direct deposits are made.

Remember that changing your direct deposit is not the same as canceling direct deposit authorization, which requires a written notice of cancellation sent directly to the companies involved.

What happens if direct deposits are not authorized?

If the direct deposit is not authorized in writing, direct deposits cannot be made to your account.

A direct deposit is an electronic transfer of money. The direct deposit company will automatically reject direct deposit requests for any direct deposits not authorized in writing by you with your Direct Deposit Authorization Form.

Direct deposit authorizations are only effective when submitted to direct deposit companies in writing.

What are some factors that might cause the direct deposit to be stopped?

In some cases, direct deposits might be stopped because of fraudulent transactions, invalid information submitted to direct deposit companies, and depleted account balances.

If direct deposit is stopped, direct deposits cannot be made to your account. You need to re-establish direct deposit authorization with the direct deposit company.

Can I make direct deposits of child support?

Yes, you can make direct deposits of child support. A Direct Deposit Authorization Form will authorize direct deposits for child support payments or any other direct deposit that may be authorized by you.

You can direct deposit child support to any bank or online account. Make direct deposits of child support only for the benefit of your children. Do not direct deposit more than is needed for their needs because the direct deposit of child support can have tax consequences on you, as well as penalties if direct deposits are not authorized.

What if my direct deposit is lost?

If direct deposit has been lost by the direct depositor, notify the direct depositor immediately. Direct deposits are lost when direct deposits have not been credited to an account or have improperly posted to another person's account.

How do direct deposits work?

Once the direct deposit is authorized through a Direct Deposit Authorization Form, it will be processed on your payday. After that, you no longer receive a paper check or use direct deposit. The direct deposit must be sent at least twice a month and include your full paycheck amount of money. Otherwise, you can elect to direct deposit on a monthly basis.

Direct deposit is typically processed within two business days after it has been received by the financial institution. The direct deposit is then available on your account within 24 hours.

What is direct deposit used for?

There are several purposes why the direct deposit is used, which include:

- to receive wages or salary;

- for social security and unemployment benefits;

- for tax refunds; or

- for direct deposits from retirement plans and pensions.

Applying for direct deposit is an easy, convenient, and secure way to get your money quickly and directly deposited into your account.

What causes a delay in direct deposit?

There are many reasons direct deposit may experience a delay. It includes:

- inaccurate or missing account information;

- out-of-cycle direct deposit requests;

- direct deposit validation errors;

- direct deposit request cancellation by a payer; and

If there is a delay in direct deposit, immediately inform the depositor.

What are the disadvantages of direct deposit?

There are no disadvantages to direct deposit. Direct deposit is a reliable, safe, and convenient process. Direct deposit ensures funds will be available when they should be — on time and in full. It eliminates the need for postage, envelopes, checks, and late arrivals caused by mail delays.

However, direct deposit can be a cause of concern for those who do not have a bank account and must rely on someone else to cash their check for them. Direct deposit is just one more step in the process that can cause problems if not done or provided by someone close to them.

What are the benefits of a Direct Deposit Authorization Form?

Using a Direct Deposit Authorization Form allows you to authorize your employer or financial institution to directly deposit funds on your bank account. With your depositor being authorized to use your bank account to deposit funds, you will experience the convenience and security of direct deposit offers.

If you allow your depositor to directly deposit funds into your account, you no longer have to be concerned about writing checks or having them deposited by someone else. Direct deposit eliminates the need to provide your payer with an alternate mailing address for direct deposit of funds which helps you ensure that your payment is not lost in the mail or delayed by another party.

Direct deposit also allows your employer to save time and money, which could be used elsewhere. This process is faster, easier, more secure, and more accurate than writing a check or providing cash. It offers you the convenience of being able to access your pay information 24 hours a day through online banking or telephone banking services.

Can I sign a Direct Deposit Authorization Form electronically?

Yes, you can sign a Direct Deposit Authorization Form electronically. You can use your electronic signature to seal your Direct Deposit Authorization Form. If you do not sign it, your letter is deemed invalid.

If you do not want to sign your Direct Deposit Authorization Form electronically, you can just fill it out online and print it after. Then, sign it using a blank-inked pen.

What are the benefits of direct deposit for employees?

There are many benefits to direct deposit for employees including:

- reduced or eliminated check-cashing fees;

- savings in time and money;

- protection against loss of paychecks through mail delays;

- possible reduction in the frequency of errors; and

- increased accuracy in recording time worked due to direct entry into the payroll system.

Direct deposit has also been shown to increase payroll security and lower the risk of fraud. Direct deposit can be done to a bank account, Credit Union, or debit card.

Is a voided check required for direct deposit?

No, a voided check is not required for Direct Deposit. A direct deposit does not require the use of a voided check because your bank account information is stored electronically in your employer's system or financial institution.

You may be asked for your ABA routing and account number so the direct deposit can be properly set up.

Do all employers use direct deposit?

No, not all employers use direct deposit.

However, as more employers begin to use direct deposit as an option, those who choose not to may find it increasingly difficult to recruit employees. Direct deposit provides several benefits for both employers and employees.

While there are some who believe direct deposit to be a violation of the right to receive a paper pay statement, it is unlikely that such arguments will prevail. Direct deposit has become widely used and accepted as an efficient and reliable method of payment.

Direct deposit is increasing in popularity among employers worldwide due to the benefits it offers over traditional methods of payment. If your employer uses direct deposit, you will receive a letter explaining how it works.

Direct deposit is commonly used in government, financial institutions, corporations, and insurance firms. Your employer may use it to withhold and remit payroll and withholding taxes and to pay employee benefits. Direct deposit may be used for one-time payments, such as bonuses and reimbursements, or regularly scheduled recurring payments, such as salary. Direct deposit is also available to independent contractors who work on a regular basis.

What documents should I have to get a direct deposit?

You need to provide the following information to get direct deposit:

- Bank's mailing address — The bank's mailing address is located on your check or bank statements. Your bank sends statements to the address you provided when you opened your account. Be sure to keep these documents in a safe place for future reference. They are useful if any of your direct deposit information changes.

- Account number — You may also find your account number on your check or bank statements. Check with the bank to make sure you have entered the account number exactly as it appears on your statement and, if not, try entering it in all capital letters. Direct deposit may be delayed until any errors are corrected.

- Bank's routing number — A routing number is a nine-digit number located on your check or bank statement above the account number. Direct deposit will not be set up unless you provide all of the necessary information. A routing number is also called the American Bankers Association (ABA) number.

- Account type — Direct deposit can be set up only to a checking or savings account. If your paycheck is direct deposited into a certificate of deposit (CD), money market, or mutual fund account, you may experience delays in getting the check cashed.

- Your mailing address — Direct deposit requires your mailing address because your employer is responsible for mailing your paycheck. Your address must be the current address of record on file with your bank. Otherwise, you may experience delays in getting paid.

- Social Security Number — Direct deposit requires your Social Security number. You should provide this information if you want to use direct deposit for payroll and withholding taxes, government agency payments, Supplemental Security Income (SSI) Direct Express Debit MasterCard transactions, retirement plan distributions, and child support payments.

- Other Identification — Direct deposit requires your name and other information, generally including your bank account number. Direct deposit uses this information to identify you as the recipient of direct deposits.

Does direct deposit go to a checking or savings account?

Direct deposit can be set up only to a checking or savings account. However, you must consider having your direct deposit in your checking account since a savings account is limited to six withdrawals or transfers per month. Direct deposit is considered an electronic fund transfer (EFT) and, therefore, counts against your authorized monthly number of transactions.

Direct deposit cannot be set up to an investment or trust account because the account must be closed. Direct deposit is not available for credit union accounts because credit unions do not use routing numbers to identify member accounts, as banks do.

Direct deposit is not possible if you have a pre-paid card or prepaid checking account that does not offer check writing services unless you close the account and open a new one.

What is a savings account?

A savings account is a deposit account that lets you save your money and earn interest on it. It is one of the safest investments because your money is insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000.

The FDIC is a federal agency that maintains and supervises deposit insurance, the program that insures your deposits at FDIC-member banks and savings associations. It aims to protect you from losing money if an FDIC- member institution fails.

Even though a savings account lets you earn interest on your money, it has limited withdrawal options. Usually, there is no daily limit on the number of withdrawals you can make but may impose a monthly limit. Savings accounts also do not pay as much interest as other types of deposit accounts, such as certificates of deposit (CDs).

Is Direct Deposit secure?

Yes, direct deposit is secure because your employer will not have access to your bank account information, and it ensures that your paycheck is safe and intact. Direct deposit is the best way to receive your paycheck because it saves time, reduces expenses, and minimizes errors.

Does direct deposit get you into financial trouble?

No, direct deposit is not likely to get you into financial trouble because your paycheck will only go into the account that you authorized for direct deposit. Direct deposit helps you manage your money better by allowing you to schedule regular transfers, payments, and withdrawals.

Can I use direct deposit if I am self-employed?

Yes, but it depends on what direct deposit options are offered by your bank. If you have a business account at the bank, they may offer direct deposit to that type of account. You can also ask the bank what other options are available for businesses.

What is a checking account?

A checking account is a deposit account that can be used for direct payment of bills, cashing checks, receiving electronic payments, writing checks, or getting cash from an automated teller machine (ATM). A checking account is not an interest-bearing account, so you will not earn interest on your money.

A checking account is different from a savings account in that it allows unlimited transactions. The main difference between the two accounts is that your money in a checking account is theoretically always available for withdrawal, while money in savings accounts is generally associated with longer notice periods and holds placed on withdrawals.

Create a Direct Deposit Authorization document, e-sign, and download as PDF.

Related Articles:

Keywords: direct deposit authorization form direct deposit authorization direct deposit form direct deposit authorization letter authorization for direct deposit direct deposit letter