Fillable Form 8990

Form 8990 is used to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year.

Fill and sign 8990 online and download in PDF.

What is Form 8990?

Form 8990, also known as Limitation on Business Interest Expense Under Section 163(j), is a form issued by the IRS to calculate the amount of deductible business interest expense. It also calculates transferable amounts for next year.

The IRS 8990 Form calculates these values under Section 163 (j) of the Internal Revenue Code (IRC). The section details the limitations on the business interest in different conditions and situations. If Section 163 (j) applies to you, then the business interest expense should not exceed the sum of:

- Your business income for the year

- 30% of your adjustable tax income this year

- Your floor plan financing interest expense this year

If you cannot deduct certain expenses under Section 163 (j), the IRS will carry over these expenses to the following year as a disallowed business interest expense carryforward.

Who is required to file Form 8990?

Usually, taxpayers with a business interest income, a disallowed interest expense carryforward, or excess business interest are required to file the IRS Form 8990 unless otherwise excluded.

In addition to this, IRS tax form 8990 is also filed by:

- A pass-through entity that is transferring excess taxable income or excess business interest to its owners.

- A regulated investment company that pays dividends to Section 163(j)

- A U.S. shareholder of a Controlled Foreign Corporation (CFC) that can find Section (j) applicable in any circumstance

- A specified CFC parent group must file an additional 8990 tax form to demonstrate the combined limitations of all CFC members.

Who is excluded from filing Form 8990?

There are, however, exclusions to filing Form 8990. The following are exceptions in filing From 8990:

- A small business taxpayer— a taxpayer that is not considered a tax shelter as defined by the IRC section 448(d), Limitation on use of cash method of accounting. Generally, small business taxpayers do not fall under Section 163(j).

- If the taxpayer only has business expenses for one or more of the following exceptional trades or businesses:

- Trade or business of providing services

- An electing real property trade business

- An electing farming business

- Certain regulated utility businesses (such as electricity, water, gas, and sewage disposal services)

Instructions to fill out Form 8990

Get a copy of 8990 template in PDF format.

Get a copy of 8990 template in PDF format.

First, get a fillable Form 8990 from PDFRun. Then, provide the following information:

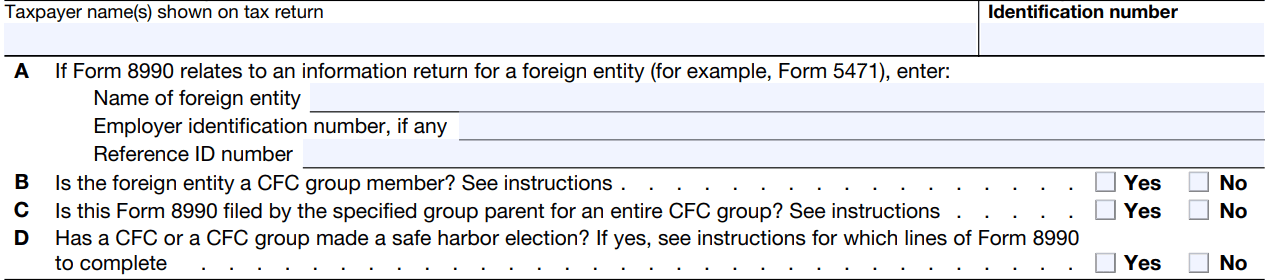

Section 0: Taxpayer Information

Taxpayer’s Name

Input your name here. The name must be identical to the name that is written on your tax return.

Tax Identification Number

Input your Tax Identification Number here. If you do not have one, you can use your Social Security Number.

Name of Foreign Entity

If this form and the expenses that are listed are related to a foreign entity (such as a CFC), input the name of the related foreign entity. Otherwise, you can leave this blank.

Employer Identification Number

If this form is related to a foreign entity, input the Employer Identification Number of the related foreign entity. Otherwise, you can leave this blank.

Reference ID Number

If the form is related to a foreign entity, input the Reference Identification Number of the related foreign entity. Otherwise, you can leave this blank.

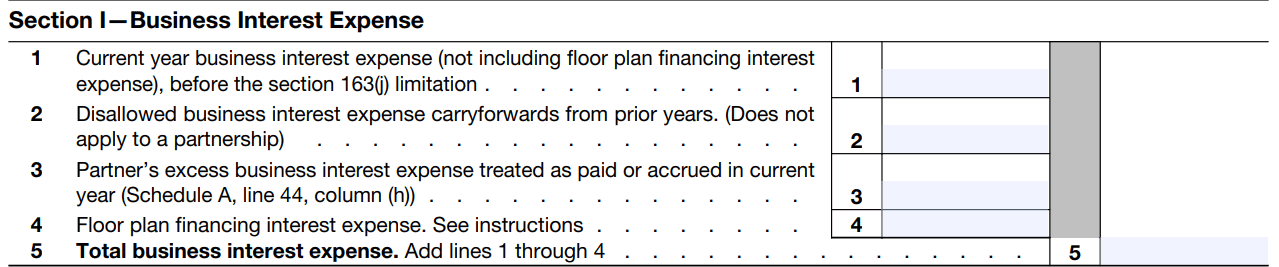

Section 1: Computation of Allowable Business Interest Expense

All taxpayers filing this form are required to fill out this part. However, if you are a shareholder or partner of a pass-through entity that is subject to Section 163 (j), fill out Schedule A and Schedule B below before filling out this part.

Line 1

Input the business interest expense of the current year, before the 163 (j) limitation. This does not include the floor plan financing interest.

Line 2

Input the disallowed business interest expense carryforwards from past years. This does not apply if you are in a partnership.

Line 3

If you are in a partnership, input your partner's excess business interest treated as paid or accrued in the current year. You can find this information at Schedule A, Line 44h.

Line 4

Input your floor plan financing interest expense.

Line 5

Input the total of lines 1 to 4 to get the total business interest expense.

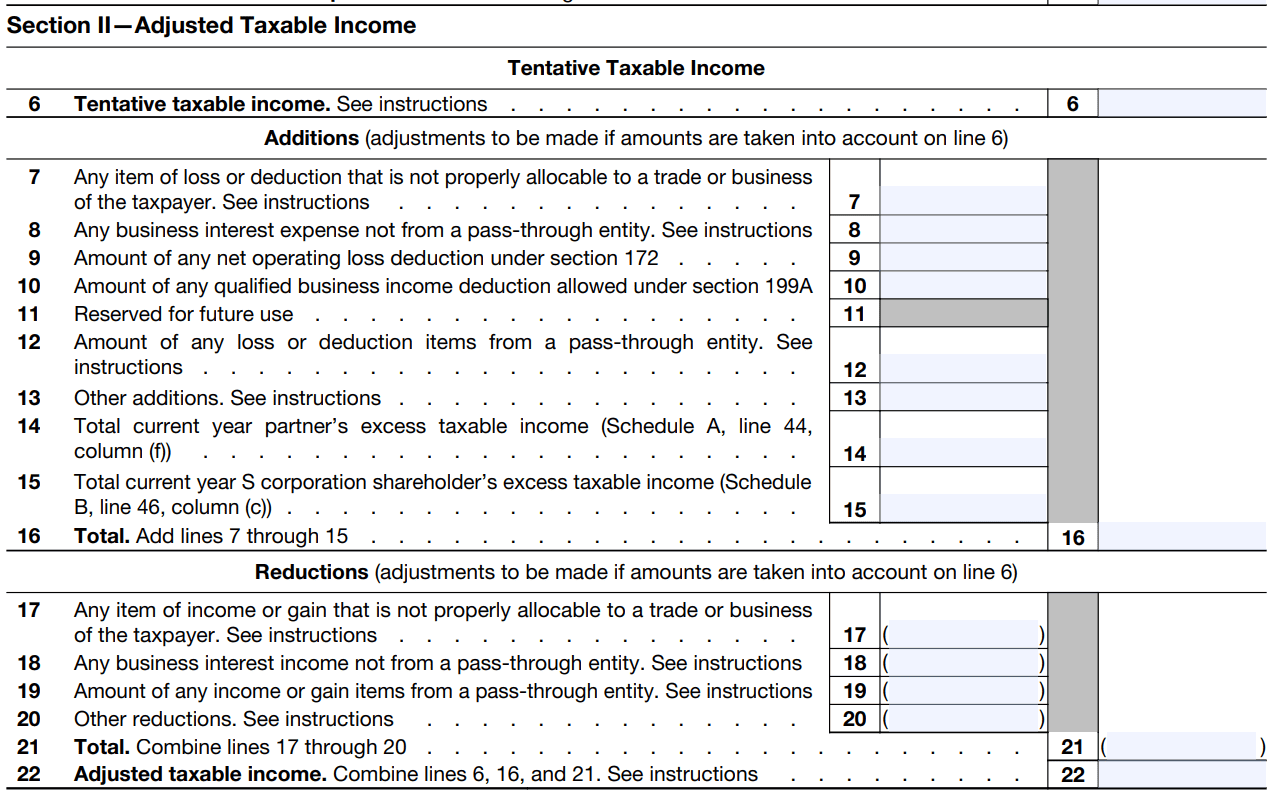

Section 2: Adjustable Taxable Income

Line 6

Input your tentative Taxable Income here.

Additions

The total of the amounts from Line 7 to Line 15 will be added to your tentative taxable income.

Line 7

Input the value of any item of loss or deduction that is not properly allocable to your trade or business.

Line 8

Input the total of all business interest expenses that are not from a pass-through entity.

Line 9

Input the total amount of all net operating loss deductions under Section 172, Net Operating Loss Deduction.

Line 10

Input the total amount of any qualified business deduction allowed under section 199A, Qualified Business Income.

Line 11

Input the total amount of valid deductions for depreciation, amortization, or depletion of your trade or business.

Line 12

Input the total amount of any loss or deduction from a pass-through entity.

Line 13

Enter the total amount of any capital loss carryback or carryover.

Line 14

If you are in a partnership, input the total of your partner’s excess taxable income. You can this information on Schedule A, Line 44c.

Line 15

If your business is classified as an S Corporation, input your shareholder’s excess taxable income. You can find this information in Schedule B, Line 46c.

Line 16

Input the total amount of Lines 7 to 15.

Reductions

The total amount of lines 17 to line 20 will be deducted from your tentative taxable income

Line 17

Input the total amount of any income or gain that is not allocable to your trade or business.

Line 18

Input the total amount of all business interest income that is not from a pass-through entity.

Line 19

Input the total amount of any income or gain that is earned from a pass-through entity.

Line 20

Input other forms of reductions, including but not limited to the floor plan financing interest expense.

Line 21

Input the total amount of lines 17 to line 20.

Line 22

Combine Lines 6 and 16. Subtract Line 21. This is now your Adjusted Taxable Income. If the total is zero or less input “-0-”

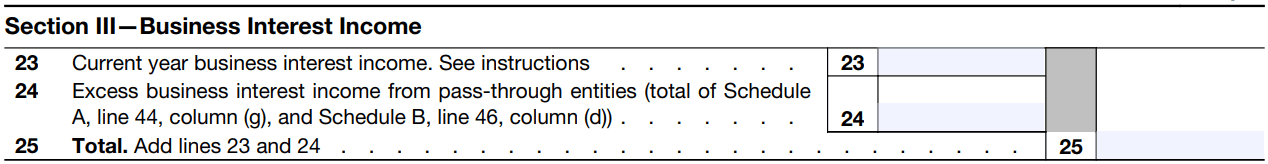

Section 3: Business Interest Income

Line 23

Input your business interest expense for the current year.

Line 24

Input the total amount of excess business interest income from pass-through entities (you can get this figure by combining Schedule A, Line 44g, and Schedule b Line 46d).

Line 25

Add lines 23 and 24.

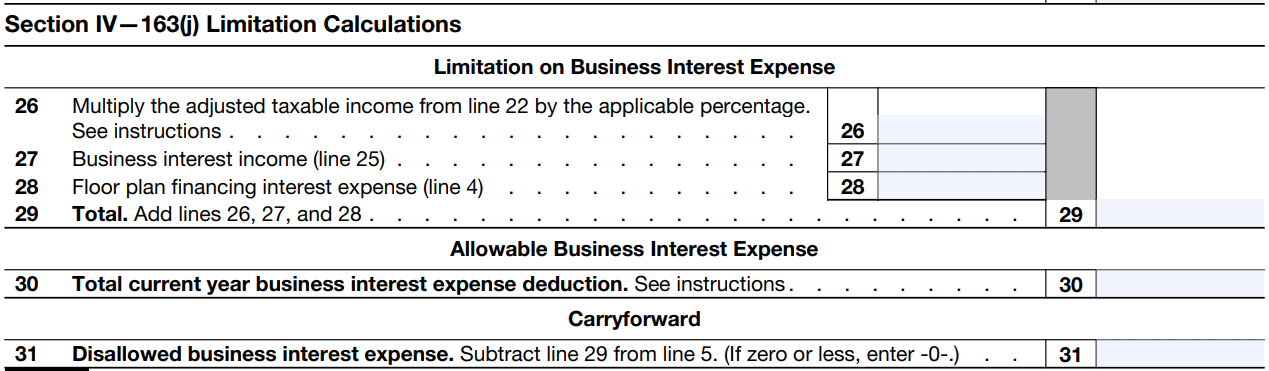

Section 4: 163(j) Limitation Calculations

Line 26

Multiply the adjusted taxable income (Line 22) by the applicable percentage. Usually, this is 30%, however, under the Coronavirus Aid, Relief, and Economic Security Act (CARES), the applicable percentage is 50% beginning in 2019 and 2020.

This 50% limitation does not apply to partnerships for tax years beginning in 2019.

Line 27

Input the total business interest income (Line 25).

Line 28

Input your floor plan financing interest expense (Line 4).

Line 29

Input the total of Lines 26, 27, and 28 to get the total limitation of business expenses.

Line 30

Input either the amount shown on Line 5 or Line 29, whichever is the lower.

Line 31

Subtract line 29 from line 5. Input the difference.

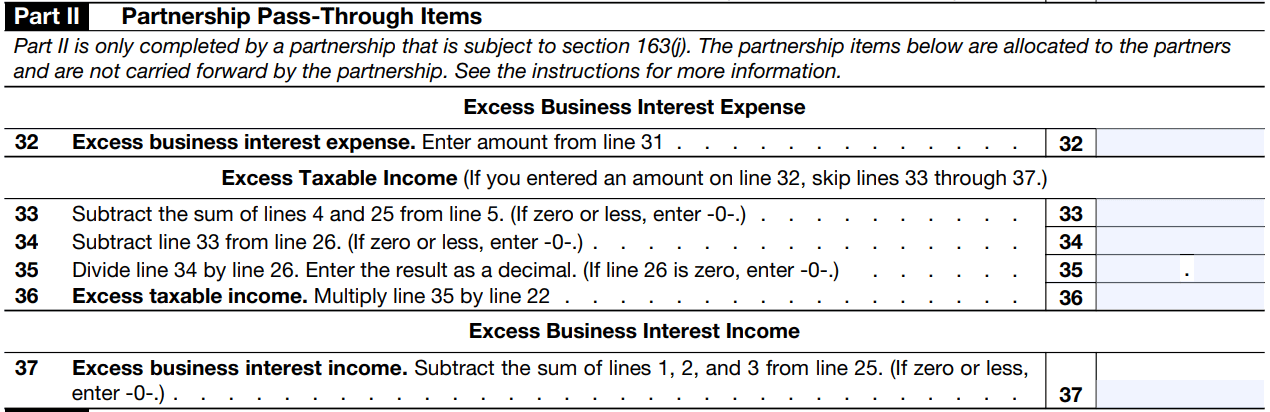

Section 5: Partnership Pass-Through Items

This part is only to be completed by a partnership that is subject to Section 163(j).

Line 32

Input the amount from line 31

Line 33

Add lines 4 and 25. Then, subtract the sum from Line 5 (If zero or less, input “-0-”).

Line 34

Subtract Line 33 from line 26 (If the result is zero or less, input “-0-”).

Line 35

Divide line 34 by line 26. Input the quotient as a decimal. If Line 26 is 0, enter “-0-”.

Line 36

Multiply Line 35 and line 26.

Line 37

Add lines 1, 2, and 3. Then subtract the sum from line 25 (If the result is zero or less, input “-0-”).

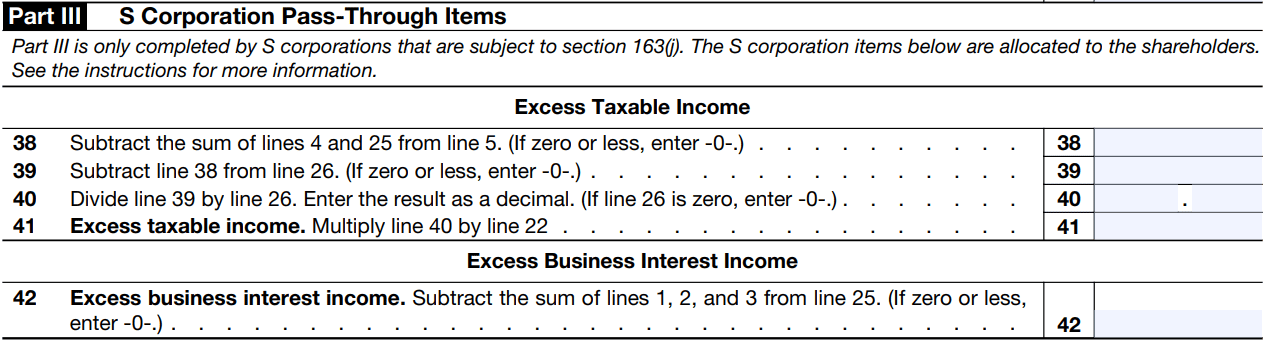

Section 6: S Corporation Pass-Through Items

Only S corporations that are subject to 163(j) will fill out this part of the form.

Line 38

Add lines 4 and 25. Then, subtract the sum from Line 5 (If zero or less, input “-0-”).

Line 39

Subtract Line 38 from line 26 (If the result is zero or less, input “-0-”).

Line 40

Divide line 39 by line 26. Input the quotient as a decimal. If Line 26 is 0, enter “-0-”.

Line 41

Multiply Line 40 by Line 22.

Line 42

Add lines 1, 2, and 3. Then subtract the sum from line 25 (If the result is zero or less, input “-0-”).

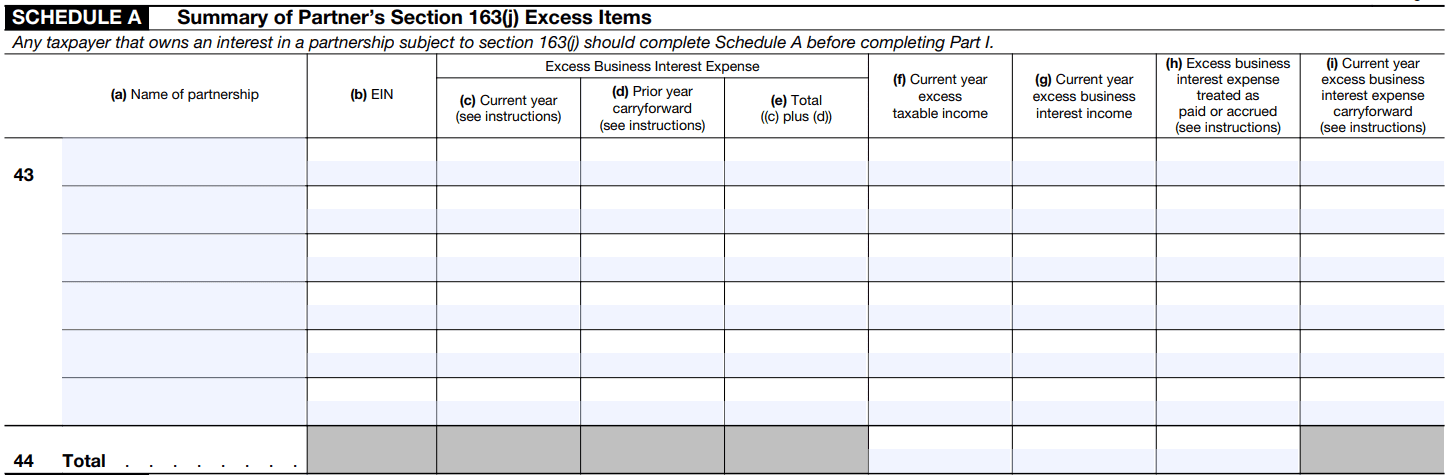

Section 7: Schedule A

If you are in a partnership, fill this schedule out.

Line 43

This is where you will input all of the values of your partner’s items.

Line 43a

Input the name of the partnership here.

Line 43b

Input the Employer Identification Number of the partnership here.

Line 43c

Input the excess business interest expense of your partner for the current year.

Line 43d

Input the excess business interest expense of your partner for the proper year carryforward.

Line 43e

Input the total of 43c and 43d.

Line 43f

Input your partner’s excess taxable income for the current year.

Line 43g

Input your partner’s excess business interest income for the current year.

Line 43h

Input your partner’s excess business interest expense treated as paid or accrued. Input the lesser between the same amount in Line 43e or the total of Lines 43f and 43g.

Line 43i

Subtract Line 43h from 43e. Subtract any excess business interest expense that previously reduced basis that you are required to make a basis adjustment upon disposition of partnership interest.

Line 44

Here is where you total the values you entered in Line 43. Note that there is no 44a, 44b, 44c, 44d, 44e, and 44i. These spaces should not be filled out.

Line 44f

Input the total of all the values written down in 43f. Also, input this value in Part I, Line 14.

Line 44g

Input the total of all the values written down in 43f. Also, input this value in Part I, Line 24.

Line 44h

Input the total of all the values written down in 43h. Also, input this value in Part I, Line 30.

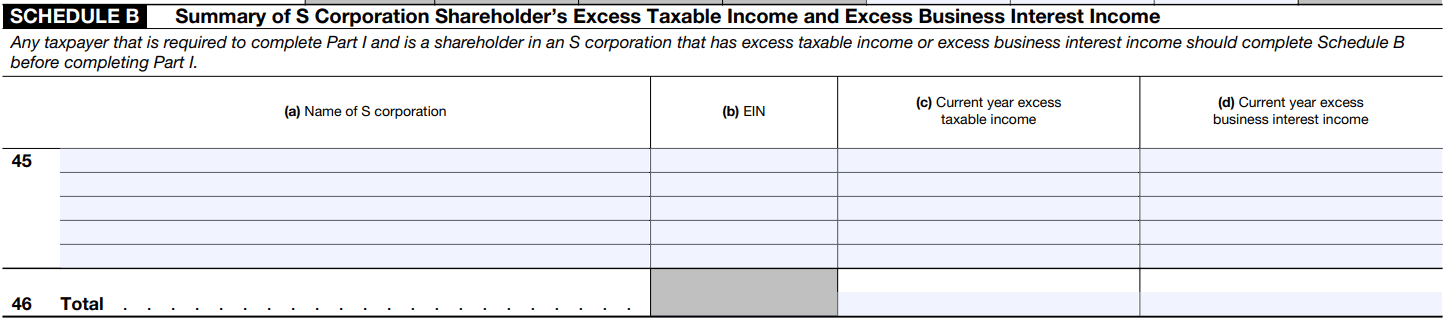

Section 8: Schedule B

If your business is classified as an S Corporation, fill this schedule out.

Line 45

This is where you will input all of the values of your partner’s items.

Line 45a

Input the name of the S Corporation here.

Line 45b

Input the Employer Identification Number of the S Corporation here.

Line 45c

Input your corporation’s excess taxable income for the current year.

Line 45d

Input your corporation’s excess business interest income for the current year.

Line 46

This is where you input the total of the values you entered in Line 45.

Line 46c

Input the total of all values inputted in 45c.

Line 46d

Input the total of all values inputted in 45d.

Start filling out a 8990 sample and export in PDF.

Frequently Asked Questions (FAQs)

What is an S Corp?

An S Corporation is a business structure that passes corporate income, losses, deductions, and credits directly to shareholders for federal tax purposes, avoiding double taxation.

When does an S Corporation need to file Form 8990?

According to the IRS Instructions for Form 8990, an S Corporation must file Form 8990 if it has business interest expense and fails the small business exemption (average gross receipts over $29 million or tax shelter status).

Who is subject to business interest limitation?

The business interest expense limitation under Section 163(j) applies to:

- Large Businesses: Those with average annual gross receipts exceeding $29 million (for tax years beginning in 2023, indexed for inflation).

- Tax Shelters: Even if they meet the gross receipts test, businesses classified as tax shelters are subject to the limitation.

- Partnerships, S Corporations, and Sole Proprietorships: If they fail the small business exemption, the limitation applies at the entity level (for partnerships and S Corps) and at the individual level for sole proprietors.

- C Corporations: Generally subject to the limitation unless they qualify for an exemption.

What qualifies as a business interest expense?

A business interest expense is the cost of interest on a loan taken to fund business operations or expenses.

What are examples of business interests?

Some examples of business interests include:

- Loans and Lines of Credit

- Bonds and Notes Payable

- Equipment and Vehicle Financing

- Real Estate Loans

- Business Credit Cards

- Shareholder or Partner Loans

Create a 8990 document, e-sign, and download as PDF.