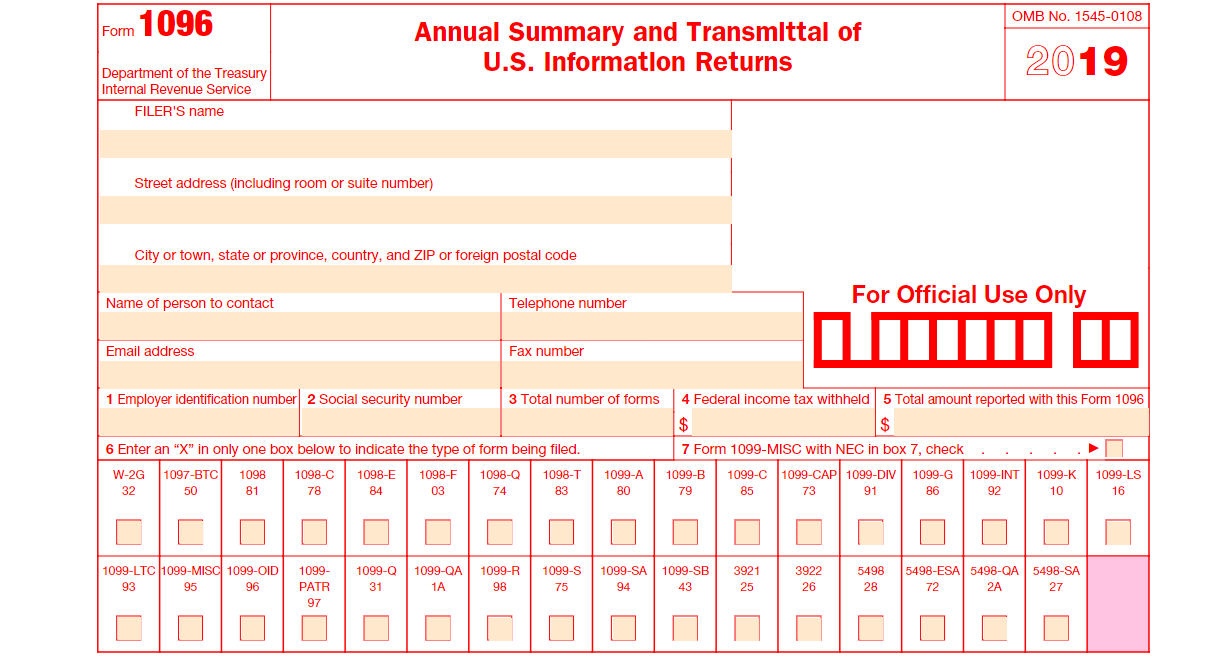

Fillable Form 1096 (2019)

Form 1096 (officially the "Annual Summary and Transmittal of U.S. Information Returns") is an Internal Revenue Service (IRS) tax form used in the United States used to summarize information returns being sent to the IRS.

What is Form 1096?

Form 1096, or Annual Summary and Transmittal of U.S. Information Returns, is a one-page transmittal form that serves as a cover sheet, reporting the summary of returns you are mailing to the Internal Service Revenue (IRS). You should only use the form if you are physically filing the accompanying forms; otherwise, if you are filing forms electronically, you do not have to use Form 1069. According to the IRS, if you have 250 or more of any type of information return, you must file electronically.

U.S. taxpayers, particularly professionals who paid more than $600 non-employee compensation to independent contractors in a financial year and used Form 1099, should fill out and submit Form 1096 when submitting paper reports to the IRS. Forms 1097, 1098, 3921, 3922 5498, 8935, and W-2G are legal forms that also need Form 1096.

In general, the due date for Form 1096 depends on the information returns you are submitting. With Forms 1097, 1098, 1099, 3921, 3922, or W-2G, file the form by February 28 each year, along with the returns it summarizes. With Forms 5498, file by June 1. The due dates may vary, depending on many factors, including holidays or weekends. Stay updated with IRS’s announcements during filing seasons to avoid missing deadlines.

Every type of form you submit to the IRS must come with its own Form 1096 cover sheet. The federal agency treats every version of its forms as a separate type of form. As an example, you should use different Form 1096 for different versions of Forms 1099.

Filing IRS forms late results in penalties. If you submit within 30 days of the due date, the penalty is $50 per form. The penalty increases to $100 after 30 days. If you still fail to file by August 1, the penalty becomes $260. If you deliberately fail to file, the penalty becomes $530.

How to Fill Out Form 1096?

To complete Form 1096, if you are the filer, you will need to provide personal and tax-related information. The form also requires details related to the forms you are transmitting.

Provide the name (filer) and address of your business, the name of the person to contact, telephone number, email address, and fax number.

Box 1 asks for your Employer Identification Number (EIN).

Box 2 asks for your Social Security Number (SSN).

Box 3 asks for the total number of forms you are submitting with Form 1096.

Box 4 asks for the total federal income tax withheld on all the forms you are submitting. Enter “0” if you did not withhold any amount.

Box 5 asks for the total amount of reported payments on all the forms you are submitting.

Box 6 has checkboxes that you should mark. Enter an “X” in one of the boxes to indicate the type of form you are filing.

After providing the required information, sign the form, provide your title, and add a date.

Submission

You should submit Form 1096 with all information returns to the following:

Submit Form 1096 with all information return to:

Internal Revenue Service

Austin Submission Processing Center

P.O. Box 149213

Austin, TX 78741

if your principal business, office or agency, or legal residence in the case of an individual, is in Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, and Virginia;

Internal Revenue Service Center

P.O. Box 219256

Kansas City, MO 64121-9256

if your principal business, office or agency, or legal residence in the case of an individual, is in Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, and Wyoming; and

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201

if your principal business, office or agency, or legal residence in the case of an individual, is in California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, and West Virginia.

Keywords: form 1096 2019 form 1096 pdf 2019 1096 form 2019 2019 form 1096 form 1096 pdf 2019 form