Fillable Form W-4V

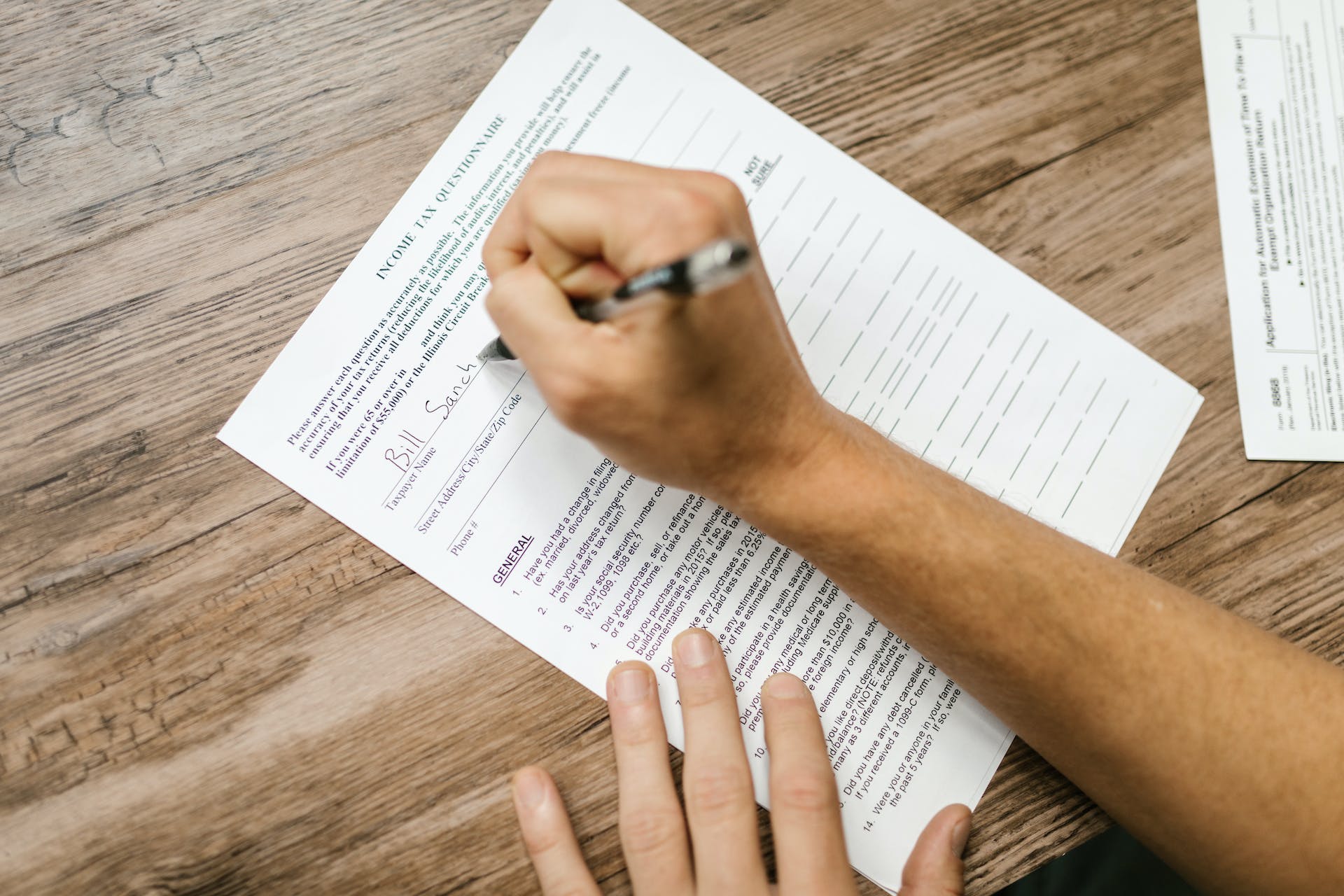

An employee completes an IRS W-4 form, or an Employee's Withholding Allowance Certificate, to indicate his tax situation to the employer. The W-4 form tells the employer the correct amount of tax to withhold from an employee's paycheck.

What are Form W-4 and W-4V?

Employee’s Withholding Certificate, is used to indicate an employee’s tax situation to the employer. Form W-4 reports the correct amount of tax or how much tax an employer should withhold from an employee’s paycheck. It is filed with the Internal Revenue Service and is often used for various other tax purposes, from reporting government payment shown, as part of tracking social security payments, or even as a general additional document alongside other related forms required when filing your taxes during Tax season.

IRS Form W-4V, on the other hand, s used to withhold the correct federal income tax by the employer.

What is the purpose of Form W-4V?

You may use IRS Form W-4V, Voluntary Withholding Request, to withhold federal income tax when you receive any unemployment compensation and certain federal government and other payments. You may use IRS Form W-4V to ask the payer to withhold federal income tax for the following:

- Social security benefits.

- Unemployment compensation including Railroad Unemployment Insurance Act (RUIA) payments.

- Your social security is equivalent to Tier 1 railroad retirement benefits.

- Commodity credit corporation loans.

- Crop disaster payments under the Agricultural Act of 1949 or under Title II of the Disaster Assistance Act of 1988.

- Dividends and other distributions from Alaska Native Corporations to his or her shareholders.

It is not a requirement to withhold your federal income tax from the said government payments. This request is purely voluntary. Moreover, you may consult your payer if you’re not sure whether your payment is eligible for voluntary withholding or not.

When can I file Form W-4V?

If you are already receiving benefits and then decided to withhold, you will then need to file Form W-4V, Voluntary Withholding Request, and submit the application form by mail or in-person to your local social security office. You can use Form W-4V to withhold federal taxes when you file your claim for social security benefits payment.

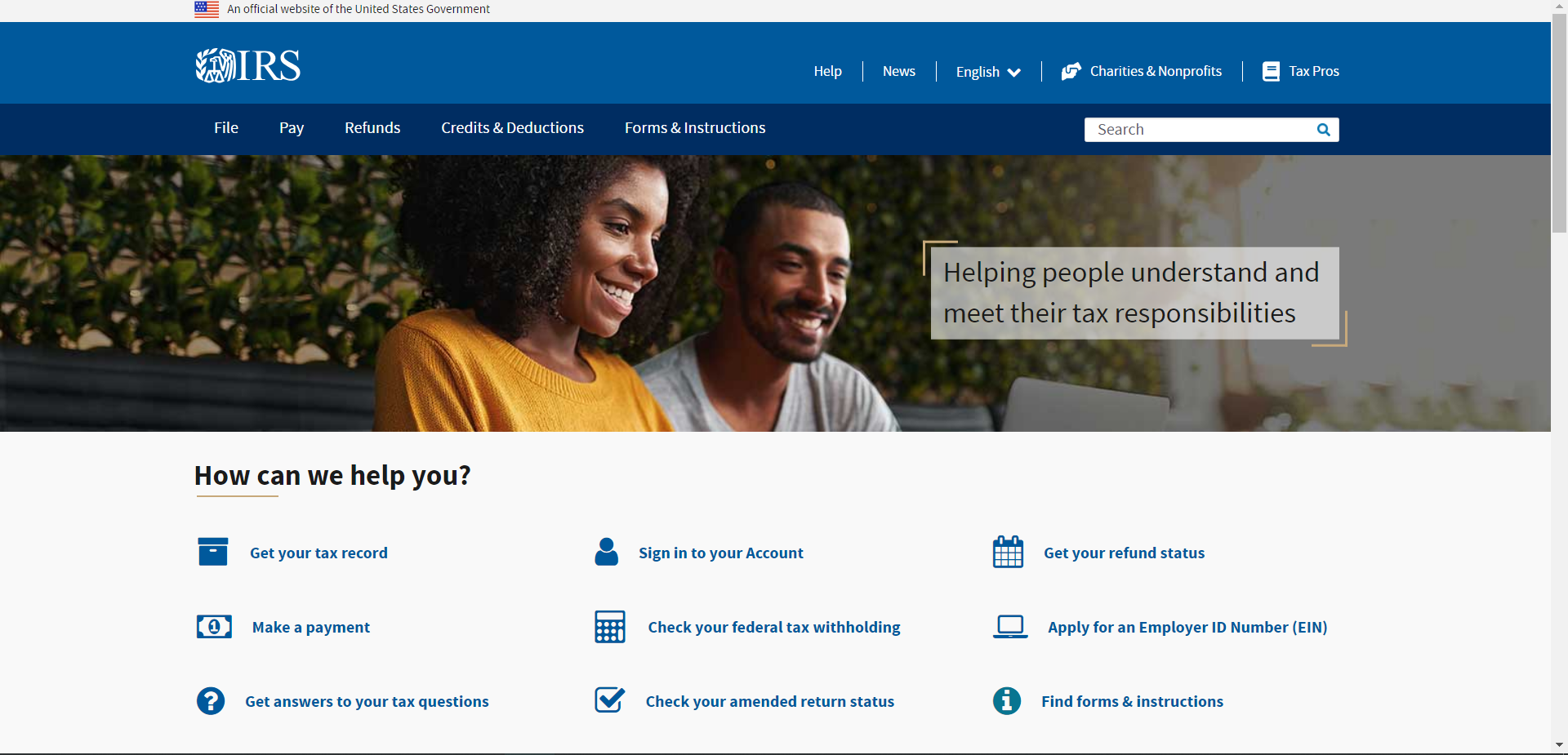

Should you require any additional assistance, consider hiring a tax professional to help you with filing IRS Form W-4V and any other tax forms you require. You may also contact the IRS through the IRS toll-free number. You can also go to the IRS website and go through the communication channels there.

Reminder

- Your social security benefits are taxable if your net income exceeds over $25,000 for a single person and $32,000 for a married couple filing together. You will be charged up to 85% of taxes from your benefits if the reported income is above the said threshold.

- You are at full retirement age when you reach 65 years or older and you can get the full social security retirement benefits tax-free. Yet, part of your benefits may subject to taxation if you are still working. The Internal Revenue Service (IRS) sums the values for your earnings and half your social security benefits. Your benefits are taxed, whenever the total exceeds the Internal Revenue Service’s income limits.

- You may get in touch with the Social Security Administration to withhold your taxes from your monthly benefit checks if you are still required to pay taxes on your social security benefits. Note that the said benefit is only applicable to federal income taxes.

- While you do not necessarily need to file multiple copies of IRS Form W-4V, it may be beneficial to have multiple copies of the form so that you have copies available in the event that you need it in the future.

How to fill out Form W-4V?

LINE 1

YOUR FIRST NAME AND MIDDLE INITIAL

Enter your first name and middle initial.

LAST NAME

Enter your last name.

LINE 2

SOCIAL SECURITY NUMBER

Enter your social security number (SSN) or employer identification number (EIN).

LINE 3

HOME ADDRESS

Enter your address starting with street number and street name or rural route.

CITY OR TOWN

Enter your city or town.

STATE

Enter the state.

ZIP CODE

Enter the ZIP code of your address.

Note: If you reside outside the United States territory, enter on Line 3 the city, province or state, and name of your country.

LINE 4

CLAIM OR IDENTIFICATION NUMBER YOU USE WITH YOUR PAYER

Enter your identification or claim number.

For withholding from social security benefits, the claim number is also the social security number under which a claim is filed or benefits are paid (Example: 123-45-6789A or 123-45-6789B6).

You can also contact the Social Security Administration at 1-800-772-1213 to know the claim or identification number you need to use.

LINE 5

Mark the appropriate box if you want the federal income tax withheld from your unemployment compensation. The payer will withhold 10% from each payment. Otherwise, leave it unmarked.

LINE 6

Your income tax will withhold from the following:

- Social security benefits.

- Social security equivalent Tier 1 railroad retirement benefits.

- Commodity credit corporation loans, crop disaster payment amount under the Agricultural Act of 1949 or under Title II of the Disaster Assistance Act of 1988.

- Dividends and other distributions from Alaska Native Corporations to its shareholders.

Then, mark the percentage you want to withhold either 7%, 10%, 15%, or 25%.

SIGNATURE

All the information you provided in Form W-4V are essential requirements for having your federal income tax withheld from certain payments, but withholding is not required by law.

Review and check the information you provided before signing and dating the form.

Where to submit Form W-4V?

Submit the completed Form W-4V to your local Social Security Administration office.

Tips when filing Form W-4V

- Payers have a choice to develop their own form for you to file a federal income tax withholding. If they give you its own form instead of the official Form W-4V, use the given form.

- Filing a request for federal income taxes withheld is quite a bit more convenient than making estimated tax payments every quarter. Nonetheless, if you have other income that is not subject to withholding, consider making tax payments and see Form 1040-ES, Estimated Tax for Individuals.

- The payer is allowed to withhold 10% from each payment only for unemployment compensation. Note that there is no other percentage rate or amount is allowed.

- Government payment may choose to have the payer withhold federal income tax, such as 7%, 10%, 15%, or 25% from each payment.

- The payer has the information on when your income tax withholding will begin. Your chosen federal income tax withholding in this form will still function unless you change, stop it, or when the payments stop.

- Complete a new Form W-4V if you want to change your withholding rate and if you have other payments aside from unemployment compensation. Then, give the new form to the payer.

- Complete a new Form W-4V if you want to stop your withholding. Then, fill in lines 1 through 4, check the box in line 7, and sign and date the form. Give the form to the payer.

- It's essential to double-check your Form W-4V for any errors before submission - inaccuracies may lead to delays or potential misunderstandings with the IRS.

- Keep in mind that the IRS can penalize you for underpayment of taxes. Ensure that the amount you opt to withhold covers enough of your expected tax liability for the year.

- It's recommended to review your withholding selections annually or whenever your financial or personal situation changes. You might need to adjust your withholding rate if you've had a significant event like a marriage, divorce, or the birth of a child.

- Keep a copy of your submitted Form W-4V for your records. It's important to have a record of the withholding instructions you provided to the payer.

- Always consult with a tax professional if you are unsure about any aspect of Form W-4V. They can provide guidance tailored to your unique situation, ensuring that you are making the best decisions for your financial health.

Keywords: form w 4v voluntary withholding request w-4v w-4v form form w4v irs form w4v w4-v w4v